What is a beneficiary?

- A person or an organization you name to receive your life insurance policy amount in the event of your death.

- Two types of beneficiaries are available:

- Primary beneficiary: Receives the benefit in the event of your death.

- Contingent beneficiary: Receives the benefit if the primary beneficiary(ies) are deceased.

If you do not name a beneficiary, the benefit will be paid out in accordance with group policy provisions.

Who can be a beneficiary?

- One person

- Two or more people

- Trustee

- A charity or organization

- Your estate

Watch these videos for instructions to add a beneficiary

How to add, change or remove beneficiary(ies) from a life insurance policy

Step-by-step guide

- Log into your employee portal.

- Select CU Resources (skip this step if CU Resources is your homepage.)

- Click on the Benefits & Wellness tile.

- Click on the Benefits Summary tile.

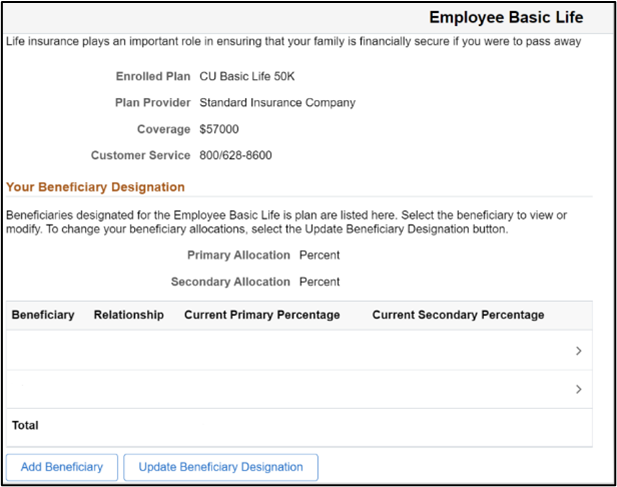

- On the summary, click on the plan(s) you want to edit beneficiaries for: Employee Basic Life, Employee Optional Life and/or Employee Voluntary AD&D.

- You can now complete the following actions:

- Add beneficiaries

- Change the percentages of current beneficiaries (the total percentage between beneficiaries must total 100 percent).

- Remove a beneficiary by changing the percentage to 0 percent. Note: If you no longer wish to see this individual in your employee portal, submit the Dependent/Beneficiary Removal Form.

- Click Save. Changes will be effective immediately.

How to designate a charity or organization as a beneficiary

Step-by-step guide

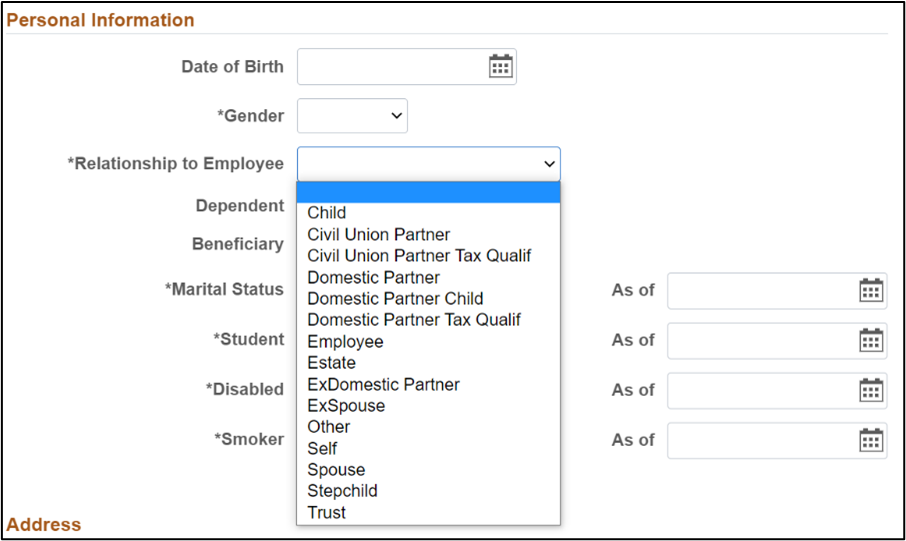

To add a trust, charity or estate as a beneficiary, the process is the same as above. However, instead of adding a person's name, you will add the name of the trust, charity, or estate.

In the Personal Information section, answer the non-applicable, required question in any way, and they will be disregarded.

- Gender - Unknown

- Relationship to Employee - Select the appropriate relationship: trust, charity (other) or estate

- Marital Status - Any

- Student - Any

- Disabled - Any

- Smoker - Any

Beneficiary designation for those without portal access

If you do not have access to the employee portal, you can remove a beneficiary using the Beneficiary Designation Form.

The Group Life Insurance Policy details the terms of life insurance policies through The Standard Insurance Co. with University of Colorado as the Policyholder.

The Group Policy Amendment No. 23 is attached to and made a part of the Group Policy above.