What’s imputed income?

Imputed income describes the value of benefits or services that are considered income when calculating your federal and FICA taxes. Imputed income only affects your gross taxable earnings, not your gross pay.

The IRS provides a list of taxable and nontaxable items that may be considered imputed income.

|

Imputed income categories and codes on your pay stub |

|

| Moving and Relocation Expenses Code: MVA As required by the IRS, all moving expenses paid by CU directly to a moving company with a purchase order OR personal relocation expenses paid with a CU credit card will be taxable to the employee. See the moving expenses tax calculator for more information. |

Taxable Tuition Waiver: Current and Former Employees Codes: TTW and TTF This benefit provides qualified employees and dependents with tuition assistance. The tax impact varies depending on each individual’s circumstance. Learn more. |

| Civil Union Partner Medical and Dental Coverage Code: NQPlan Code Employees are taxed on the difference between what CU contributes for Employee-only coverage and Employee + Spouse or Family coverage. The difference is reported and taxed as income. |

Domestic Partner Medical and Dental Coverage Code: NQPlan Code Employees are taxed on the difference between what CU contributes for employee-only coverage and employee + spouse or family coverage. This difference is reported and taxed as income. |

| Business Expense Code: BEX The taxable portion of any expense reimbursement. To avoid taxes, expense reports must be submitted within 90 days of incurring the expense. |

Life Insurance Code: STNDRD Life insurance that exceeds $50,000 is subject to federal taxes per IRS regulations. |

| Imputed Cash Award Code: ICA Any non-cash item you receive as a CU employee (gift card, iPad, etc.). |

Imputed Cash Award for Student Code: ICS Any non-cash item you receive as a CU employee (gift card, iPad, etc.). |

| Note: Any non-cash, taxable fringe benefits may increase your taxable income. | |

Where can I find imputed income on my paycheck?

Because imputed income is subject to both federal and FICA taxes, it can be found on your pay stub.

Follow these steps to view yours:

- Log into the portal.

- Click the Paychecks tile.

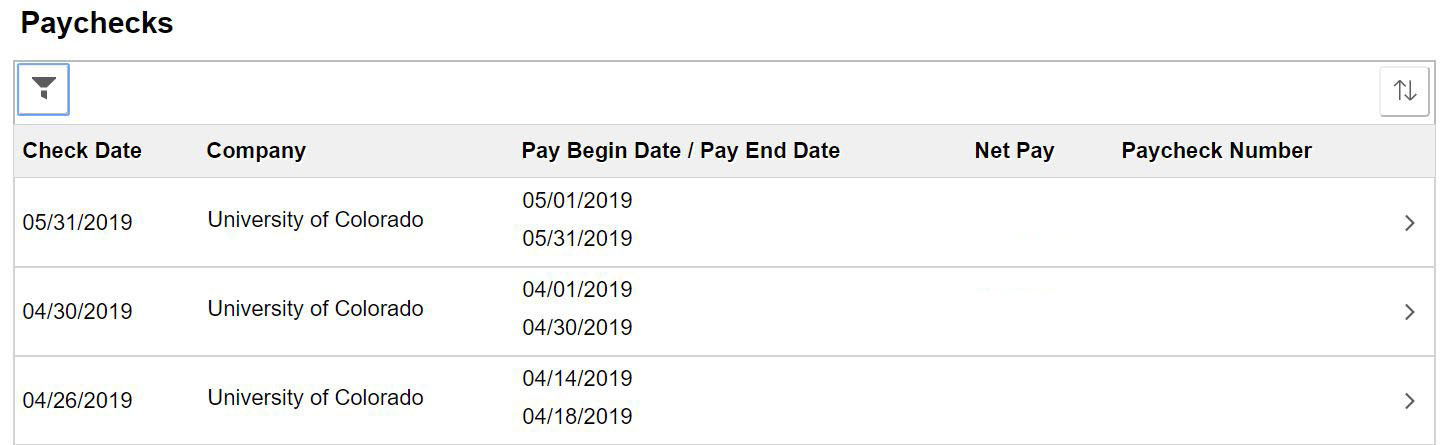

- Select the paycheck you would like to view. Note: Your paycheck will not populate if your pop-up blocker is on.

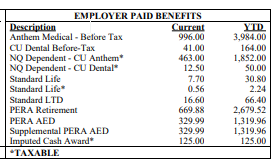

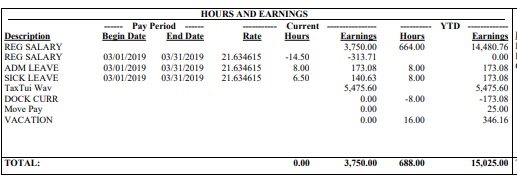

- Your paycheck will populate in a new tab. You can see a description of the items being taxed in two areas: Employer Paid Benefits and Hours and Earnings.

- Under Employer Paid Benefits, you will see Imputed Cash Award, Standard Life and Business Expense

- Under Hours and Earnings, you will see moving and relocation expenses (MVA), Taxable Tuition Waiver current employee (TTW) and Taxable Tuition Waiver former employee (TTF)

- Under Employer Paid Benefits, you will see Imputed Cash Award, Standard Life and Business Expense

Does imputed income affect my gross income?

No it doesn’t. It will affect your net pay (this is what goes into your account).

Where can I find more information on imputed income?

The IRS provides a list of taxable and nontaxable items that may be considered imputed income.