The University of Colorado Employee Services uses the scope of work form to determine if someone can be classified as an independent contractor. This determination is based on the nature of the relationship between the service provider and the university. As of March 11, 2024, the Department of Labor has tightened the requirements to classify someone as an independent contractor.

Important Notice

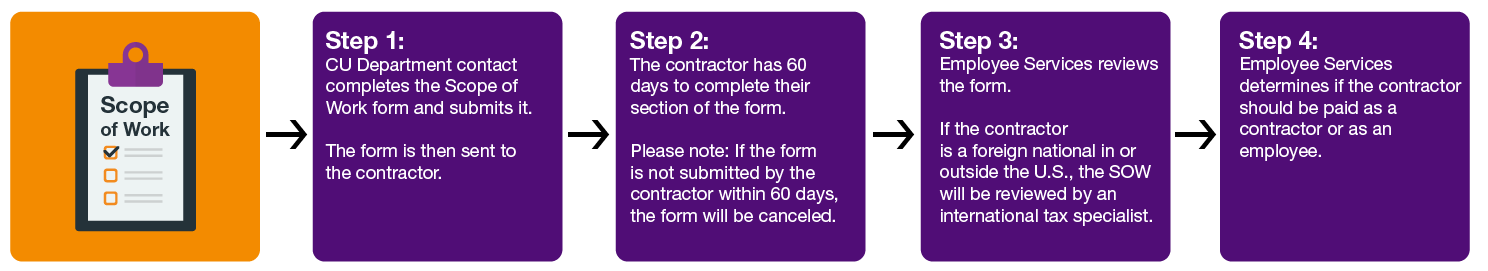

Before ANY work takes place, a Scope of Work/Independent Contractor form must be completed and approved by Employee Services for all service providers who operate under a Social Security number.

Re-engaging a termed employee as an independent contractor in the same calendar year is not recommended. Doing so—especially for similar work—can create compliance and misclassification risks under IRS and employment guidelines. Before proceeding, contact sow@cu.edu or your central HR team to review the situation and ensure proper handling.

You need work done by someone outside the university. Contract positions are generally intended for service providers working on a specific project for a finite amount of time and who are individuals or sole proprietors and do business under their Social Security number. (Note: service providers who are foreign nationals may not have an SSN.)

The first step when beginning work is to determine whether to pay them through a Scope of Work (SOW) as a contractor or as a CU employee. If classified incorrectly, your department could be subject to IRS penalties and fines (i.e. wage claims, benefits).

Reminder: A termed employee, including retirees, cannot be contracted as an independent contractor to perform the same work. (This includes temporary workers, post-docs, and anyone with a CU appointment in HCM).

The table below lays out the basics between an employee and a contractor in their relationship with the University:

| Aspect | Employee | Contractor/Consultant |

|---|---|---|

| Control | Employer directs how work is done | Contractor controls how work is done |

| Training | Provided by employer | Uses own methods/skills |

| Tools/Equipment | Provided by employer | Provides own tools |

| Schedule | Set by employer | Sets own schedule |

| Benefits | Eligible | Not Eligible |

| Tax Treatment | Employer witholds taxes | Pays own taxes |

| Duration/Integration | Ongoing, integral to operations | Temporary or project-based |

Before the work begins, use the Contractor Decision Tree (PDF), IRS Common Law Test (PDF) and Questions to Consider (PDF) to determine whether the service qualifies for independent contractor status.

To determine if a service provider qualifies as an independent contractor, ask yourself the following questions:

- Is the work focused on a specific project?

- Does the work term last for a finite amount of time?

- Will the worker be paid based on the deliverables?

- Does the work require specialized skills?

- Is the proposed work a core function of your department?

- Contract work often fills a unique or rare department need or require skills that would otherwise not be needed in ongoing day-to-day operations.

- How much control would your department have over the worker?

- Would the work enable your department to control their behavior, their finances or their long-term relationships, including the ability to contract with other entities?

None of these questions is weighted more heavily than any others, and hiring managers should consider the totality of circumstances.

The Department of Labor website has a detailed FAQ to help you understand the requirements and find solutions to specific circumstances. You can also reach out to SOW@cu.edu to ask questions about any contract position you’d like to request approval for and review a SOW Presentation (PDF) for more information.

Costs to include in your Scope of Work request

All costs proposed to be covered by the university must be fully identified on the SOW form.

Note:

- Independent contractors typically charge rates adequate to cover their miscellaneous expenses (e.g., travel).

- If these costs are not included in the service rate, then they must be listed as additional costs on the SOW form and covered using the same procurement method as the service payment (i.e., Marketplace Payment Voucher or Marketplace Requisition).

- It is prohibited to use other, separate procurement methods (Procurement Card, Travel Card or Non-Employee Reimbursement form) to cover costs associated with an independent contractor.

Background checks

A background check must be performed on service providers who will be working with minors and/or vulnerable populations. The second category includes, but is not limited to, academic programs and camps that include working or assisting with programs serving minors or at-risk adults; working or assisting in child care facilities; spending the night in a situation where minors are present; or, providing housing for minor undergraduate students.

The background check must be completed by HR and can be started during or after the SOW approval process, but it must be completed before work can begin.

Hiring PERA retirees

The process for hiring a CU PERA retiree varies on how they are reporting their income:

- EIN (Employee Identification Number): Active PERA retirees who operate under an EIN must complete PERA’s Disclosure of Compensation form each time they receive a payment and email it to Employee Services at Thomas.Martinez@cu.edu. A Scope of Work review process is not necessary.

- Independent Contractor Social Security number: If the PERA retiree is a proposed independent contractor and operates under a Social Security number, a Scope of Work review process is necessary.

If you contract with a PERA-affiliated retiree—either as an independent contractor or through an affiliated party—they must submit a Disclosure of Compensation form each month they provide services and receive payment. The form is available on page 18 of the Colorado PERA Working After Retirement booklet. Completed forms should be emailed to Employee Services at Thomas.Martinez@cu.edu.

Your SOW form has been approved. Now what?

Once Employee Services confirms the work can be done by an independent contractor, you will receive an email with the spproved SOW.

The service provider's classification as an independent contractor or not determines how the service provider will be paid.

Paying an independent contractor

If the individual is able to function as an independent contractor, Employee Services will return an approved SOW/Independent Contractor form to the requesting department for final payment processing. The payment is made through Marketplace (not with a PCard). Your service provider must be registered as a supplier in Marketplace to receive payments.

Please note: Review and Approval Process for Payment

Employee Services is responsible for reviewing the nature of the work to ensure proper classification under Internal Revenue Service (IRS) guidelines. This step ensures compliance with tax regulations and accurate reporting.

Separately, the Procurement Service Center (PSC) reviews the purchase to confirm adherence to the University of Colorado’s procurement policies. Please note that approval from Employee Services does not eliminate PSC requirements. All payment requests must proceed through the PSC purchasing process, and a Payment Voucher (PV) or Purchase Order (PO) will only be generated after PSC completes its compliance review.

Payment method is determined by the total dollar amount and frequency of the payments:

- When total payment is $10,000 or less: As invoices are received, complete the Payment Voucher form in CU Marketplace and attach the approved SOW form and contractor invoice(s). Multiple payment vouchers may be used if the contractor submits multiple invoices. However, total payment may not exceed $10,000. Review the PSC Procedural Statement.

- When total payment is more than $10,000: Prior to any work being performed, complete the appropriate form in CU Marketplace and attach approved SOW form. In addition to the form, the PSC may require a formal quote or Statement of Work from the service provider to be included in your Marketplace requisition.

As invoices are received, email them to APinvoice@cu.edu for payment.

Paying an employee (current or termed within the same calendar year)

For a current employee: If an employer-employee relationship currently exists and your SOW request was denied, payment is made through Payroll. In this case, Employee Services notifies the department of the proper course of action of service payment through an Additional Pay form.

For a former employee who was active within the same calendar year: A recently termed employee may meet requirements for a finite period of contracting work; however, this arrangement can be a red flag for IRS auditors. Engaging in such a relationship could subject your department to an audit and compliance scrutiny.

If the SOW is approved by Employee Services and your HR team, you would pay for their services as an independent contractor (refer to the Independent Contractor section for details). For tax purposes, they will need to submit both 1099 and W-2 wages.