Why Run This Report:

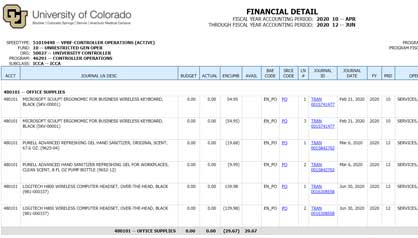

- To view an itemized list of all transactions for revenue, expense, and balance sheet accounts.

- To view an itemized list of all transactions for a specific account code(s) or account code range.

- To view an itemized list of transactions across fiscal years.

Key Notes

Tips

- Financial Detail (Original) vs Financial Detail II

- Original has a more concise presentation, ex. good for JE documentation; is still the default report when drilling from summary reports

- II has more detail and is more customizable, ex. good for researching transactions across speedtypes or digging deeper with reconciliations

- II has a Single SpeedType search option

- You can customize your list of account codes using specific a/c or ranges of a/c in the search

- Detail results can cross fiscal years and go back to July 1999

FAQs

Q: There are two Financial Detail reports. When might I use one report rather than the other?

A: The Financial Detail II is the more customizable of these two reports. Use this report if you want to add extra information to your report or control the way certain information, like Concur report details or employee names, displays on the report. You might use this report to reconcile a SpeedType or research expenses.

The original Financial Detail offers a straightforward list of transactions for an account or group of accounts. You might use this report as supporting documentation for a cost transfer journal entry.

Q: Is there a standard Accounting Period to select? What are some of the differences in these time periods?

A: The Financial Detail reports display an itemized list of transactions for a given date range. The date range (periods) you enter depend on your intended use of the report. Here are a few examples:

- If you are reconciling a single period, you may want to select that period in both the From and To fields. This will give you a list of itemized transactions for that period alone.

- If you are supporting a cost transfer JE, select the period in which that expense was incurred as the From field and the current period as the To field. This will demonstrate that the expense was charged to that SpeedType/Account and that it is still present in the account, avoiding a duplicate cost transfer.

- If you are running these reports after the close of a fiscal year, your selections depend on the account code range.

- For balance sheet accounts - Select period 0 in the From field and period 998 in the To field as this will capture final balances for the fiscal year.

- For income sheet accounts - If the SpeedType is project-related, and you want to see cumulative balances, select period 0 in the From field. If you only want to see activity of that year, don’t include period 0. To capture final balances for the fiscal year, select period 998 in the To field.

Q: When I purchase through Marketplace, is there anywhere that I can add information that will show up in the description in this report? Currently it defaults to whatever comes from the vendor, which is often confusing.

A: When you are adding SpeedType and Shipping details to a requisition in CU Marketplace, you have the option to add Financial Report Comments to the individual requisition lines. This is available on the Requisition Summary tab. Scroll down to the Supplier/Line Item Details and click the edit button next to the line. There, you can add your information to the Financial Report Comments. Remember to click Save. These comments will show on the m-Fin Financial Detail reports.

for full screen.

for full screen.