APS #4014

Fiscal Roles and Responsibilities

Outlines fiscal roles and responsibilities of employees by providing clarification and guidance regarding the framework within which financial management occurs.

To outline fiscal roles and responsibilities of all employees for all university funds.

I. Introduction

This policy statement establishes the fiscal rolesFiscal roleThe categorization of Employees to indicate their fiscal responsibilities to the University as defined in Administrative Policy Statement Fiscal Roles and Responsibilities. Categories include Officers, Fiscal Principals, Fiscal Managers and Fiscal Staff. and responsibilities of employeesEmployeesAn individual who currently holds a University employment appointment, whether full-time, part-time, temporary, seasonal or hourly. by providing clarification and guidance regarding the framework within which financial management occurs. This policy applies to all university fundsUniversity fundsAll funds appropriated, generated, awarded, donated or otherwise received by the University regardless of their source. The term University Funds does not include Agency Funds (Fund 80) that the University maintains for legally separate External Student Organizations or other entities – with the exception of CU Medicine/UPI Fund 80 funds. and to all employees.

II. Policy Statement

The University has a fiduciaryFiduciaryThe obligation arising from a position of authority to act on behalf of another (as in managing the University's operations) where one assumes a duty to act in good faith and with care, candor, and loyalty. responsibility to fulfill its overall mission ethically and in compliance with applicable policies, laws, regulations, and rules, and contracts, grants, and donor restrictions. Accordingly, the University is obligated take reasonable actions to ensure that: university fundsUniversity fundsAll funds appropriated, generated, awarded, donated or otherwise received by the University regardless of their source. The term University Funds does not include Agency Funds (Fund 80) that the University maintains for legally separate External Student Organizations or other entities – with the exception of CU Medicine/UPI Fund 80 funds. are used only for official university businessOfficial university businessAny activity that carries out the university's mission of instruction, research and service or that provides support to the university's instruction, research, and service activities. and that they are accounted for accurately in the University's financial records. Furthermore, the University must establish and maintain Internal controls which strive to achieve specific goals. (Among these goals: protection of university assets from unauthorized access or theft; authorization and recordkeeping procedures to achieve accurate, reliable financial management information; promotion of operational efficiency and effectiveness; reasonable compliance with all applicable policies, laws, regulations, and rules, as well as contracts, grants, or donor restrictions; proper segregation of duties so that no one controls all phases of a transaction unless a waiver has been granted in writing by the appropriate campus Controller due to the implementation of adequate compensating controlsCompensating controlsProcedures used to mitigate risks inherent in Internal Controls arising from approved waivers of segregation of duties. Detailed explanations are available at https://content.cu.edu/controller/policiesandprocedures/accountinghandbook/internal_compensating_controls.html.; and, an effective process of continuous assessment and adjustment for any changes in conditions that affect the internal controls.)

To facilitate the successful fulfillment of this obligation, all employeesEmployeesAn individual who currently holds a University employment appointment, whether full-time, part-time, temporary, seasonal or hourly. are required to complete, within a reasonable time frame, the University’s required fiscal training program(s). Employees are further required to carry out their designated fiscal responsibilities.

Fiscal Roles

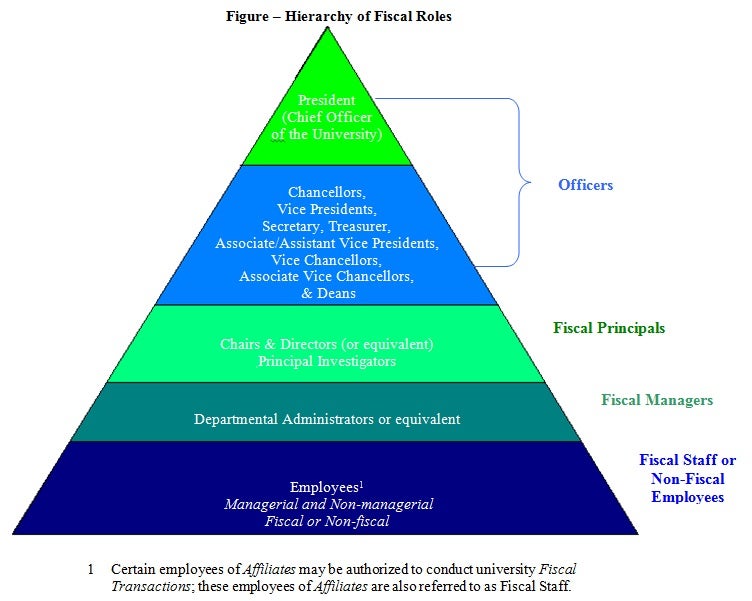

The following figure illustrates the types and related hierarchy of fiscal rolesFiscal roleThe categorization of Employees to indicate their fiscal responsibilities to the University as defined in Administrative Policy Statement Fiscal Roles and Responsibilities. Categories include Officers, Fiscal Principals, Fiscal Managers and Fiscal Staff. within University management.

Officers

The term Officers refers to the President, other Officers of the University, and Officers of the Administration.

President

The President is the chief officer of the University responsible for compliance of all University fiscal matters with applicable policies, laws, and regulations [Regent Law 3.B.1].

Officers of the University

As defined in Regent Law, other Officers of the UniversityOfficers of the universityDefined in Regent Article 3.B: Officers of the University. include the secretary, treasurer, and university counsel. Each of these positions has specific functional reporting responsibilities to the Regents. These positions are entrusted with fiscal responsibility to the President for their assigned Organizational unitsOrganizational unitA subset of University operations. An Organizational Unit may be a department or any other distinct operational activity with the following characteristics: • Organizational permanency; • Programmatic autonomy; and • An annual operating budget that is fiscally independent. Within the Finance System, these areas are represented on the ChartField tree as Orgs. as well as for their functional area of responsibilityFunctional area of responsibilityA group of related business objectives, processes and entities for which an Officer has oversight by virtue of her/his position that have the following characteristics: organizational permanency and programmatic autonomy..

Officers of the Administration

As defined in Regent Policy, Officers of the AdministrationOfficers of the administrationDefined in Regent Article 3.C: Officers of the Administration. are those individuals who hold the title or interim/acting title of vice president, chancellor, associate vice president, assistant vice president, vice chancellor, associate vice chancellor, associate university counsel, and deans of the schools, colleges, and libraries. Further, on written request, the President may designate other officers of the administration, which will be recorded in the respective letter of offer and also in the University’s official personnel roster. These positions are entrusted with fiscal responsibility to the President or appropriate organizational supervisor for their assigned organizational units as well as for their functional area of responsibility.

Within the Officers of the Administration, the President has delegated to the positions of Vice President of Budget and Finance and University Controller the overall staff responsibility for the development and implementation of the financial management guidelines. Specifically, as detailed in the Administrative Policy Statement, Controller Function Decentralization, the University Controller has the authority over, and responsibility for, developing fiscal policies in consultation with the campus controllers (including accounting principles, standards, and procedures common to all campuses), and for seeking all exceptions to State Fiscal Rule (except if delegated in writing to a campus controller or other individual).

Fiscal Principals

According to Regent policy, Chairs (or equivalent position titles) are the principal administrators of the school or college’s departments, and are accountable to the Deans. Directors (or equivalent position titles) are the principal administrators of organizational units, such as institutes, centers, and administrative departments, accountable to an Officer of the Administration (or other Fiscal PrincipalFiscal principalsAs defined in Administrative Policy Statement Fiscal Roles and Responsibilities, Chairs, Directors and Principal Investigators (or equivalent titles) as the result of their assigned fiscal responsibility.). With these appointments, Chairs and Directors (or equivalent position titles) are entrusted with fiscal responsibility for their assigned Organizational units.

Under federal regulations, each Sponsored Project Sponsored projectsSponsored project awards are "exchange transactions" between an external sponsor and the University under a grant, contract, cooperative agreement, purchase order, or any other mutually binding award that restricts the use of funds or property and stipulates conditions with which the University must comply. The typical sources of such receipts include organizations at all levels of government (local, state, federal, or international) as well as private corporations and foundations.has an identified Principal Investigator or faculty member charged with the responsibility for the administration and fiscal oversight of the Sponsored Project. With these appointments, Principal Investigators (or other faculty members) are entrusted with fiscal responsibility for their assigned Sponsored Project.

To emphasize the fiscal responsibility of these positions, these positions are designated as Fiscal Principals accountable to the designated Officer (or other Fiscal Principal).

Fiscal Managers

To facilitate the accomplishment of financial management objectives, an Officer or, where delegated by an Officer a Fiscal Principal, may designate employee(s) within the Officer’s Functional area of responsibility (suchas Departmental Administrators or other position titles) as key employee(s) with the authority and responsibility for Fiscal TransactionsFiscal transactionsFinancial transactions occur within numerous University functions including Accounting, Human Resources, Payroll and Benefits, Procurement and Student Services. EXAMPLES OF FISCAL TRANSACTIONS Function/Transaction • Accounting o Asset Transfers/Disposition o Cash Transfer o Journal Entry (JE) o Interdepartmental Invoice/Order • Human Resources, Payroll and Benefits o Create or Modify Position (Employment Management) o One Time Payment (Payroll) o Payroll Expense Transfer (PET) o Payroll Funding Distribution o Time Collection Entry • Procurement (Purchasing, Payables or Travel) o Cash Advance o Departmental Purchase Order o International Travel Meal Diary Form o Official Function Form o Petty Cash o Procurement Card Allocation o Procurement Card Purchase o Payment (Expense) Voucher o Purchase Requisition o Standing Purchase Order Renewal/Requisition o Travel Authorization/Advance o Travel Voucher o Unavailable Documentation • Student Services / Bursar o Cash Receipt o Financial Aid Award o Tuition and Fee Charge o Tuition Waiver. To emphasize the fiscal responsibility of these positions, these positions are designated as Fiscal ManagersFiscal managersAs defined in the Administrative Policy Statement Fiscal Roles and Responsibilities, the key employee in the Organizational Unit with the authority and responsibility for its fiscal transactions..

Fiscal Staff

Many other employeesEmployeesAn individual who currently holds a University employment appointment, whether full-time, part-time, temporary, seasonal or hourly. of the University are involved in university Fiscal Transactions, such as initiating purchases, receiving cash or other negotiables, entering or reviewing transactions into the Finance SystemFinance systemThe University's official financial records, used to record all University fiscal transactions and prepare the University's financial statements., monitoring contractors, or verifying compliance. These employees are referred to as Fiscal StaffFiscal staffAs defined in Administrative Policy Statement Fiscal Roles and Responsibilities, Employees (other than Fiscal Managers, Fiscal Principals, and Officers) of the University involved in University fiscal transactions, such as initiating purchases, receiving cash or other negotiables, entering or reviewing transactions into the University's Finance System, monitoring contractors, verifying compliance.. In addition, certain employees of AffiliatesAffiliateAn organization that has a contractual or other legal relationship with the University that closely aligns them operationally with the University to more effectively further both the University and the organization's missions. Affiliates are identified at https://www.cusys.edu/controller/policies/supporting%20listing.doc. Affiliates include Blended Organizations and Supporting Organizations. may be authorized to conduct university financial transactions. These employees of Affiliates are also referred to as Fiscal Staff.

Non-Fiscal Employees

All other employees are hereafter referred to as Non-Fiscal Employees in this policy.

Fiscal Responsibilities

The University carries out the following financial responsibilities in order to reasonably prevent Fiscal MisconductFiscal misconductAs defined and illustrated in the Administrative Policy Statement Fiscal Misconduct Reporting and as defined by Regent Policy 13.E: Fiscal Misconduct – fiscal misconduct means a deliberate act or failure to act in the course of university employment regarding fiscal matters, contrary to established law, rule, or policy, with the intent to obtain an unauthorized benefit, which results in loss or other damage to the university or university faculty, staff, student or university affiliated entity. Fiscal misconduct includes, but is not limited to: - embezzlement or misappropriation of university funds, goods, property, services, or other resources; - improper handling or reporting of financial transactions; - authorizing or receiving compensation for goods not received or services not performed; - authorizing or receiving compensation for hours not worked; - forgery or unauthorized alteration of financial documents or records; - diverting funds to an unrelated private enterprise that otherwise could be available to the university; and - suspected fiscal misconduct that is a reasonable belief or actual knowledge that fiscal misconduct has occurred or is occurring. Fiscal misconduct also includes attempted fiscal misconduct. Attempted fiscal misconduct exists when an employee, with the intent to obtain a financial gain, engages in a deliberate act or failure to act that constitutes a substantial step towards committing fiscal misconduct, even though that act or failure to act did not result in loss or other damage to the university or university faculty, staff, student, or university affiliated entity. and other errors, and then, where prevention was not achieved despite the employees’ EmployeesAn individual who currently holds a University employment appointment, whether full-time, part-time, temporary, seasonal or hourly.reasonable efforts, to provide for timely detection and reporting.

- The University, through the Office of University Controller with assistance from the campus controllers and the University Leadership Development Institute, will provide training and support on fiscal rolesFiscal roleThe categorization of Employees to indicate their fiscal responsibilities to the University as defined in Administrative Policy Statement Fiscal Roles and Responsibilities. Categories include Officers, Fiscal Principals, Fiscal Managers and Fiscal Staff. and responsibilities.

- All Employees (including Officers, Fiscal PrincipalsFiscal principalsAs defined in Administrative Policy Statement Fiscal Roles and Responsibilities, Chairs, Directors and Principal Investigators (or equivalent titles) as the result of their assigned fiscal responsibility., Fiscal ManagersFiscal managersAs defined in the Administrative Policy Statement Fiscal Roles and Responsibilities, the key employee in the Organizational Unit with the authority and responsibility for its fiscal transactions., Fiscal StaffFiscal staffAs defined in Administrative Policy Statement Fiscal Roles and Responsibilities, Employees (other than Fiscal Managers, Fiscal Principals, and Officers) of the University involved in University fiscal transactions, such as initiating purchases, receiving cash or other negotiables, entering or reviewing transactions into the University's Finance System, monitoring contractors, verifying compliance., and Non-Fiscal Employees) are entrusted with the responsibility of preserving university resources and using those resources in a prudent manner for their designated purposes, as provided by policies, laws, regulations, and rules, and contracts, grants and donor restrictions.

- Employees (whether Officers, Fiscal Principals, Fiscal Managers, or Fiscal Staff) who personally participate in a Fiscal TransactionFiscal transactionsFinancial transactions occur within numerous University functions including Accounting, Human Resources, Payroll and Benefits, Procurement and Student Services.

EXAMPLES OF FISCAL TRANSACTIONS

Function/Transaction

• Accounting

o Asset Transfers/Disposition

o Cash Transfer

o Journal Entry (JE)

o Interdepartmental Invoice/Order

• Human Resources, Payroll and Benefits

o Create or Modify Position (Employment Management)

o One Time Payment (Payroll)

o Payroll Expense Transfer (PET)

o Payroll Funding Distribution

o Time Collection Entry

• Procurement (Purchasing, Payables or Travel)

o Cash Advance

o Departmental Purchase Order

o International Travel Meal Diary Form

o Official Function Form

o Petty Cash

o Procurement Card Allocation

o Procurement Card Purchase

o Payment (Expense) Voucher

o Purchase Requisition

o Standing Purchase Order Renewal/Requisition

o Travel Authorization/Advance

o Travel Voucher

o Unavailable Documentation

• Student Services / Bursar

o Cash Receipt

o Financial Aid Award

o Tuition and Fee Charge

o Tuition Waiver have certain fiscal responsibilities as appropriate to their level of involvement. Personal participation is required by at least two individuals in every transaction. Personal participation is evidenced and certified on each transaction by a signature on the Fiscal Transaction as described in Attachment “Guidance Responsibilities include:

- Ensuring the Fiscal Transaction has proper authorization; results in no violation of the applicable Conflict of Interest policy or law1; has adequate funds allocated or otherwise available within regularly approved budgetsBudgetA set of financial expectations (usually revenues and/or expenditures) for a given fiscal period (at least annually). to cover it; occurs after reasonable consideration of the impact on the University; and, is in accordance with all University and other applicable policies, laws, regulations, and rules, and contracts, grants and donor restrictions.

- Ensuring the Fiscal Transaction is recorded in the University’s Finance SystemFinance systemThe University's official financial records, used to record all University fiscal transactions and prepare the University's financial statements. in a timely manner; in the Organizational unit’s Organizational unitA subset of University operations. An Organizational Unit may be a department or any other distinct operational activity with the following characteristics: • Organizational permanency; • Programmatic autonomy; and • An annual operating budget that is fiscally independent. Within the Finance System, these areas are represented on the ChartField tree as Orgs.SpeedTypeSpeedTypeCommon reference for the ChartField combination known as a FOPPS in the Finance System (or subsystems). and fiscal (accounting) period to which it relates (or which benefits from the expense and most accurately reflects its nature); using adequate descriptions of transactions and correct ChartFieldsChartFieldsThe individual components (fields of information) that represent the coding structure used by the University's Finance System (and subsystems) to record a transaction. Detailed explanations are available here.; and, in accordance with all other university accounting policies.

- Maintaining on file or submitting to the appropriate University Administrative OfficeUniversity administrative officeAn Organizational Unit that performs a specific functional service for the campus or University, such as the Budget Offices, Procurement Service Center, Human Resources, Sponsored Projects Accounting, Office of Grants and Contracts, Finance Office, Accounting Office, Payroll and Benefit Services. original supporting (source) documentation for the Fiscal Transaction in accordance with minimum documentation levels and time periods specified in applicable university policy.

- Providing accurate representations and source documentation related to the Fiscal Transaction, in a timely manner, at the request of an Officer or University Administrative Office.

Furthermore, all approvers have specific additional responsibilities, including:- Challenging any transaction that does not appear to be an appropriate expenditure of university fundsUniversity fundsAll funds appropriated, generated, awarded, donated or otherwise received by the University regardless of their source. The term University Funds does not include Agency Funds (Fund 80) that the University maintains for legally separate External Student Organizations or other entities – with the exception of CU Medicine/UPI Fund 80 funds.. This means that if the approver is uncertain as to the propriety of the transaction, the approver must refer the matter to the next higher-level Fiscal Role for further evaluation and approval.

- Not approving their own transactions, and not approving any transactions for their supervisors.

- All Officers have responsibilities to take reasonable actions to ensure Employees within the Officers’ Functional area of responsibility have been informed about their fiscal roles and are properly carrying out their fiscal responsibilities. If a fiscal role or responsibility has not been assigned to an Employee within the Officers’ Functional area of responsibilityFunctional area of responsibilityA group of related business objectives, processes and entities for which an Officer has oversight by virtue of her/his position that have the following characteristics: organizational permanency and programmatic autonomy., Officers are required to carry out the fiscal role or responsibility personally. Officers must participate personally in the Financial Report Review ProcessFinancial report review processAs required by the Administrative Policy Statement Fiscal Roles and Responsibilities, policies and procedures that result in the routine review of financial information. This is a key control to ensure all fiscal transactions are properly recorded in the Finance System and to detect fiscal misconduct. The fundamental components of this process include:

• Detailed review of fiscal transactions, including a reconciliation of each individual transaction appearing on the financial report to the related source documentation;

• Periodic analysis of planned fiscal activity or budget in relation to actual fiscal activity;

• Comparison and analysis of prior year financial activity to current year financial activity where appropriate.

Procedures always include taking appropriate investigative and remedial action. (as detailed below)and also fulfill the following fiscal responsibilities as appropriate for their Functional area of responsibility and considering delegations (understanding that personal participation cannot be fully delegated):

- Providing guidance and direction to subordinate Employees in carrying out their assigned fiscal duties as described below.

- Taking appropriate investigative, reporting and remedial action as a result of the Financial Report Review Process consistent with their assigned fiscal duties as detailed below.

- Setting a tone within their Functional area of responsibility (and the University as a whole) for ethical conduct and integrity, as outlined in the Administrative Policy Statement, Fiscal Code of Ethics.

- Reasonably ensuring the maintenance of Internal controls through continuous assessment and adjustment, and initiating immediate discussions and disclosures of any Reportable Conditions and Material WeaknessesMaterial weaknessesA Significant Deficiency that would not prevent or timely detect a material error in the University's financial reports. in Internal controls with the appropriate campus Controller.

- Ensuring that operational plans within their Functional area of responsibility are aligned with established University and campus objectives, including, as appropriate, the formulation of budgets.

- Identifying and documenting the delegation of approval authority within their Functional area of responsibility, with careful consideration for proper segregation of duties; prevention of fraudFraudIncludes certain illegal acts; misstatements arising from fraudulent financial reporting; and misstatements arising from misappropriation of assets. Fraudulent illegal acts are characterized by deceit, concealment, or violation of trust and perpetrated to obtain money, property or services; to avoid payment or loss of services; or to secure personal or business advantage. Misstatements arising from fraudulent financial reporting are intentional misstatements or omissions of amounts or disclosures in financial statements to deceive financial statement users. Misstatements arising from misappropriation of assets involve the theft of an entity's assets., abuseAbuseThe result of behavior that is deficient or improper when compared with behavior that a prudent person would consider reasonable and necessary given the facts and circumstances. Abuse is distinct from an illegal act or other law violation that occurs when laws, regulations, or rules, or contracts, grants or donor restrictions are violated. Abuse usually results in an inappropriate use of University resources, such as excessive cost for an acquired good or service. or conflict of interestsConflict of interestSituations defined in the Administrative Policy Statement Conflict of Interest Policy in which financial or other personal considerations may compromise, or have the appearance of compromising, an employee's professional judgment in administration, management, instruction, research and other professional activities. This includes situations in which an employee might derive private gain due to her/his association with the University.; and university policies preventing further delegation.

- Ensuring that their own approval authority is carried out properly.

- Taking reasonable actions to ensure that the approval authority they have delegated is carried out properly.

- Being knowledgeable about their responsibility and accountability for the operations of their Functional area of responsibility (regardless of delegation).

- Annually completing the statements required by the Administrative Policy Statements Fiscal Certification and Officer Disclosures of Interests.

- All Fiscal Principals have the responsibility to take reasonable action to ensure that subordinate employees within their Responsibility UnitsResponsibility unitRefers to the level of Organizational Unit or Sponsored Project for which an individual Fiscal Principal has responsibility. have been informed about their fiscal roles and are properly carrying out their fiscal responsibilities. If a fiscal role or responsibility has not been assigned to an employee within their Responsibility Units, Fiscal Principalsare required to personally carry out the fiscal role or responsibility. Fiscal Principalsmust personally participate in the Financial Report Review Process (as detailed below) and also do the following fiscal responsibilities as appropriate for their fiscal roles and considering their delegations (understanding that personal participation cannot be fully delegated):

- Providing guidance and direction to subordinate employees in carrying out their assigned fiscal duties as described below.

- Initiating appropriate investigative, reporting and remedial action as a result of the Financial Report Review as outlined below.

- Ensuring that their own approval authority is carried out properly, and taking reasonable actions to ensure that the approval authority they have delegated is carried out properly.

- Assisting in setting a tone within their ResponsibilityUnit (and the University as a whole) for ethical conduct and integrity, as outlined in the Administrative Policy Statement Fiscal Code of Ethics.

- Assisting in continuously assessing and adjusting, or making recommendation for adjusting, Internal controls, and initiating immediate discussions and disclosures of any Reportable Conditions and Material Weaknesses in Internal controls with the appropriate Officer.

- Assisting in the development of operational plans within their Responsibility Units that are aligned with established University and campus objectives, including, as appropriate, the formulation of budgets.

- Being knowledgeable about their responsibility and accountability for the Fiscal Transactions of their Responsibility Units (regardless of delegation).

- Fiscal Managers must personally participate in the Financial Report Review Process (as detailed in item G6 below) and the following fiscal responsibilities as appropriate for their fiscal roles in their Responsibility Units and considering delegations to Fiscal Staff (understanding that personal participation cannot be fully delegated):

- Initiating appropriate investigative, reporting, and remedial action as a result of the Financial Report Review Process as outlined below.

- Ensuring that their own approval authority is carried out properly, and taking reasonable actions to ensure that the approval authority they have delegated is carried out properly.

- Providing guidance and direction to subordinate employees in carrying out their assigned fiscal duties by being familiar with financial policies and procedures and serving as the primary resource for subordinates’ inquiries2; identifying and making available all relevant university and Responsibility Unit policies and procedures and laws, regulations, and rules, and contracts, grants and donor restrictions; ensuring subordinates are adequately trained and fully understand their assigned fiscal responsibilities, including Finance System use; including an assessment of the subordinates’ fiscal responsibilities performance in their periodic performance evaluations; and, explaining that subordinates will be personally accountable for their actions when processing Fiscal Transactions per C.R.S. 24-30-202 (3).

- Assisting in setting a tone within their Responsibility Unit (and the University as a whole) for ethical conduct and integrity, as outlined in the Administrative Policy Statement Fiscal Code of Ethics.

- Assisting in continuously assessing and adjusting, or making recommendation for adjusting, Internal controls, and initiating immediate discussions and disclosures of any Reportable ConditionsReportable conditionSignificant deficiencies in the design or operation of internal controls that could adversely affect the University's ability to initiate, record, process, and report financial data consistent with the assertions of management in the financial statements. and Material Weaknesses in Internal controls with the appropriate Officer (and Fiscal Manager orFiscal Principal, as appropriate to Fiscal Role).

- Assisting with the formulation of budgets that align with their Responsibility Unit’s operational plans.

- Being knowledgeable about their responsibility and accountability for the Fiscal Transactions of their Responsibility Unit (regardless of delegation).

- Fiscal Managers have the following assigned fiscal duties (unless assigned to Fiscal Staff through job descriptions) related to their Responsibility Units:

- Providing timely notification to the appropriate campus Controller’s office to accurately identify the Position NumberPosition numberA unique identifier for each employment position in the University's Human Resources Management System (HRMS).3 of the immediate (next higher) responsible Officer, FiscalOfficial, and Fiscal Manager for each FOPPS FOPPSAn acronym (Fund, Organization, Program, Project, Subclass) commonly referred to as a SpeedType. These terms represent an accounting cost center in the Finance System (or subsystems), that is, they identify where financial activity occurs.in the University’s Finance System.

- Continuously maintaining the HRMSHRMSHuman Resources Management System, or the University's official human resources records, used to manage all personnel data and actions, such as appointment position and funding management, hiring, promotion and terminations, changes to employees' personal information, salary increases, and payroll production. to accurately identify the name, University e-mail address and University phone number related to the Position Numbers.

- Informing, properly and in a timely manner, the responsible Officer (and Fiscal Manager orFiscal Principal, as appropriate) about communications from sponsors, donors, and regulatory agencies concerning Material Material/materialityA measurement or threshold to gauge the significance of a fiscal transaction. Determining materiality often involves the reasonable person test; there are two ways to gauge this question: 1. By quantity: In the University, items that are in excess of $200,000 or in excess of 5% of the revenue or expense base (whichever is less) are always considered material. 2. By quality: No matter what the amount, an item is material if the misstatement or omission makes it probable that the judgment of a reasonable person, who was relying on the information to make a decision or to take an action, would be changed or influenced.(whether resolved or unresolved) issues of noncompliance; inappropriate reporting of financial information; questioned costs; or allegations of fraud or suspected fraud.

- Ensuring that all access granted to financial information is in accordance with University policies.2

- Ensuring their own delegated approval authority is used properly.

- The Financial Report Review Process serves as the only way fraud, errors, and omissions may be detected for some transactions. Accordingly, carrying out the Financial Report Review Process, as appropriate to their Fiscal Role,to reasonably ensure that the reported Fiscal Transactions are recorded in the most appropriate SpeedType and Account as well as in accordance with university accounting policies; the reports reconcile to the Responsibility Unit’s supporting (source) documents; all Fiscal Transactions placed in Suspense AccountsSuspense accountsA ChartField that represents a temporary classification of fiscal transactions by the Finance System or its subsystems due to incomplete or invalid information being available to the system. Such activity requires an individual to make another entry to ensure the appropriate classification of the fiscal transactions. Examples include expense account 699999 used by the Procurement Card system. are resolved monthly; the reported Fiscal Transactions represent appropriate use of university resourcesUniversity resourcesOfficial resources of the institution, including but not limited to: university funds, facilities, personnel/labor, equipment (e.g., telephones, photocopy machines, computers – including email), work products, results, materials, records, or other information developed or produced with university goods or services., especially considering the Administrative Policy Statements Propriety of Expenditures and Fiscal Misconduct Reporting; the reported Fiscal Transactions were processed in accordance with University policies and procedures and other applicable laws, regulations, and rules, and contracts, grants and donor restrictions; Available ResourcesAvailable resourcesFunds legally available to an Organizational Unit to support the costs of carrying out its assigned roles or objectives, including allocated revenue budgets or spending authority (expense budgets), cash, convertible short-term assets (e.g., inventories, receivables), and allocated accumulated net assets. were sufficient to cover the reported Fiscal Transactions, considering all outstanding commitments (encumbrances); and, appropriate investigation, reporting and remedial action as described below is carried out.

- Initiating appropriate investigative, reporting and remedial action with the responsible Officer (and Fiscal Manager or Fiscal Principal, as appropriate to Fiscal Role) as a result of the Financial Report Review Process such as transferring the cost to an appropriate alternate Organizational unit in the event costs incurred and charged to the sponsored funding source are not allowable; taking corrective action for any identified or anticipated deficits immediately upon such identification, or in advance of the time that the predetermined limit of Available Resources is reached; making any appropriate reporting in accordance with the Administrative Policy Statement Fiscal Misconduct Reporting; and, informing the responsible Officer (and Fiscal Manager orFiscal Principal, as appropriate) and campus Controller(except where another University Administrative Office is indicated) about the certain types of Fiscal Transactions and other required disclosures as set forth in the Administrative Policy Statements Fiscal Certifications and Officer Disclosure of Interests.

- Serving as the primary resource for inquiries relative to the FOPPS by an Officer or University Administrative Office.

- Assisting in the maintenance (through continuous assessment and adjustment) of Internal controls, including documented organizational plans and fiscal procedures.4

III. PROCEDURES, FORMS, GUIDELINES, AND RESOURCES

- Related Administrative Policy Statements

The APS Fiscal Roles and Responsibilities is the parent policy for a suite of policies addressing fiscal management and accountability. The other policies within this suite include: - Educational Resources

Educational Resources including guides, training notifications, and newsletters are announced and available on the Office of University Controller web site.

IV. Definitions

Italicized terms used in this Administrative Policy Statement are defined in the Policy Glossary.

V. Contacts

Questions about this policy should be directed to the appropriate campus Controller who will consult with the Assistant Vice President/University Controller as appropriate.

VI. History

1/22/2018 – Removed link to discontinued PSC Procedural Statement and added link to related APS.

Revisions dated 1/1/2011

- Noted authority for developing fiscal procedures. Identified that subordinates cannot approve any transactions for their supervisors. Consolidated requirements irrespective of individual role or place in the fiscal management pyramid hierarchy.

Supersedes

- Fiscal Roles and Responsibilities Administrative Policy Statement dated 6/30/2005

- Fiscal Roles and Responsibilities Administrative Policy Statement dated 11/1/1999

ATTACHMENT A - Guidance on Fiscal Roles and Approval Authority

- 1. See Administrative Policy Statement Conflicts of Interest and Commitment.

- 2. a. b. For guidance on university policy, please consult with the appropriate campus Controller.

- 3. An individual’s Position Number can be found by searching in HRMS (using Administer Workforce – Job Data).

- 4. For guidance on Internal controls, please consult with the appropriate campus Controller