Policy 11.A: Compensation Principles

History

- Adopted: March 15, 1984 (as Regent Policy 10.E: Compensation Principles).

- Revised: February 10, 2022 - revised for changes related to the Colorado Equal Pay for Equal Work Act and made retroactive to January 1, 2021; September 7, 2023 (previously policy 10.E and renumbered to policy 11.A).

- Last Reviewed: March 15, 1984.

Policy 11.B: Faculty Salary1

11.B.1 Introduction

The university recognizes the vital importance of its faculty to the mission of the University of Colorado. Teaching students is one fundamental purpose of the university; it is faculty members who provide that instruction. The faculty convey the latest information and techniques to students so that graduates can be educated citizens and locally, nationally, and internationally competitive. Generating new knowledge is a second fundamental purpose of the university; it is faculty members who define the cutting edge of their fields of knowledge through their scholarly/creative work, which also strengthens the education of their students. Faculty members also contribute to the university’s well-being, mission, and operations through shared governance and leadership and service to the institution and the community.

The university recognizes the central role of the faculty in maintaining and furthering its mission by investing resources in them including resources to support their salaries. This policy is focused on key faculty salary principles and processes, with additional details articulated in administrative policy statements and campus policies.

Faculty salary (a portion of total compensation) is a major factor in attracting, retaining, and rewarding highly-qualified faculty and maintaining quality academic programs (see Regent Policy 11.A – Compensation Principles). It shall be a priority in annual budgetary planning.

The university is committed to identifying and remedying unlawful pay inequities. Each campus shall have a policy or mechanism for periodic review of salary structure for inequities.

11.B.2 Annual Salary Adjustments2

(A) Annual adjustments to an individual’s salary may be the result of:

(1) the annual base-building merit evaluation process;

(2) other base-building adjustments, for example, to address market, career merit inequities, salary equity, promotion, or institutional priorities; and/or

(3) non-base building adjustments.(B) Each campus shall develop a plan for allocation of the annual salary pool to schools/colleges and other academic and administrative units.

(1) The campus plan shall not include salary recommendations for individual faculty.

(2) The administration shall provide the campus faculty assembly with the opportunity to review the campus plan for allocating the salary pool.(C) Based on the dean’s authority and responsibilities as the principal academic and administrative officer of a school or college (see Regent Policy 4.A – Administration and Governance of Academic Units), the dean determines the salary pool allocation to primary units within a school or college.

(D) Notwithstanding any other term or provision of this policy, the chancellor of each campus is authorized to approve individual retirement incentive agreements for eligible faculty on the chancellor’s campus. See Administrative Policy Statement 5016 – Faculty Retirement Agreements.

2Salary adjustment may be an increase or a decrease in salary.

11.B.3 Determining Annual Salary Adjustments

A faculty member’s total base salary adjustment shall include the annual merit-based salary adjustment, and any additional base-building salary adjustments to address market, career merit inequities, salary equity, promotion, and institutional priorities. A faculty member may also receive non-base building adjustments in certain circumstances.

Steps are discussed below, which include determining the annual merit score of each faculty member; determining the merit-based, base-building salary adjustments; determining additional base-building salary adjustments; and finally, determining any non-base building salary adjustments.

As part of the annual salary process, each faculty member shall have access to a copy of their salary recommendations from all administrative levels.(A) Annual Merit Evaluation

(1) Activities and expectations for teaching, scholarly/creative work, leadership and service, and where applicable, other categories specific to the unit (e.g., clinical activity, librarianship) vary widely across and within primary units. For this reason, the unit level annual evaluation process should reasonably include both objective and subjective professional judgments. Reducing the inherent complexity of faculty activities to a strict formula is discouraged.

(2) Determinations of annual merit-based salary adjustments shall be made based on primary unit processes that are clearly articulated in a written document.(a) The faculty of the primary unit shall develop, in consultation with the chair, dean, and the provost, a process for annual merit evaluation. As described in regent policy 5.C.4(B), faculty evaluations shall be based on peer review, with exceptions at the Anschutz Medical Campus. The annual merit evaluation process shall be made known to all faculty members within a unit.

(b) The primary unit annual merit evaluation process shall consider teaching, scholarly/creative work, leadership and service, and where applicable, other categories specific to the unit (e.g., clinical activity, librarianship). The primary unit evaluation process shall lead to a determination of performance in each category. The annual merit evaluation process shall consider the individual’s agreed upon workload for the evaluation year. The overall annual merit score shall be the weighted combination, based on workload, of the individual category scores.

(c) Each primary unit shall have a mechanism that captures a uniform set of parameters for annual activities in teaching, scholarly/creative work, leadership and service, and where applicable, other categories specific to the unit (e.g., clinical activity, librarianship), including information from the annual Faculty Report of Professional Activity (e.g., faculty course questionnaire data, class size, course modality, research expenditures, acceptance rates of publication venues, etc.). This mechanism shall be clearly articulated in a written document that is available to all faculty members in the unit.

(d) In any given year, primary units may choose to evaluate parameters (e.g., publications) based on performance over multiple years (up to five years) to reflect ongoing activities that may not yield measurable results in a single year. Parameters for multiple year evaluations shall be the same as the individual year parameters.

(e) See Administrative Policy Statements 5008 - Faculty Performance Evaluations and 1009 - Multiple Means of Teaching Evaluation.

(f) The administration may review the performance scores produced by the faculty process to evaluate, as appropriate, intra- and inter-unit consistency.(B) Annual Merit-based, Base-building Salary Adjustment

(1) Using annual merit scores, each primary unit shall have a transparent process for making initial annual merit-based, base-building recommendations for salary adjustments.(C) Additional Base-building Salary Adjustments

Market, career merit inequities, salary equity, promotion, and institutional priorities may lead to additional base-building salary adjustments.(1) Campuses shall have a transparent process for evaluating needs and awarding salary adjustments to address market, career merit inequities, salary equity, promotion, and institutional priorities. The processes should also consider and address inequities arising from these related adjustments.(D) Total Annual Base-building Salary Adjustment

(1) Based on the recommendations in sections 11.B.3(B)(1) and 11.B.3(C), the annual base-building salary adjustment shall be made by the primary unit to the dean who shall then issue a recommendation to the provost and chancellor for final approval.(E) Non-base Building Adjustments

Faculty members may be awarded non-base building salary adjustments based on merit and in accordance with specific criteria and guidelines approved by the campus chancellor. These salary adjustments may be awarded for no more than one academic year at a time; however, they may be renewed in subsequent years.(1) Faculty who perform work outside their regular duties or at a substantially higher level than their regular assignment may be awarded a non-base building salary supplement. This may include teaching or other work beyond the faculty members’ standard assignment and is not associated with a differentiated workload.

(2) Faculty who have an administrative appointment may qualify for a non-base building administrative salary supplement with approval by the dean and, as may be required, the provost, chancellor, or president.

(3) Faculty who have received an approved monetary recognition or achievement award may be issued a non-base building salary supplement.

11.B.4 Appeal Processes

(A) Faculty members who are not satisfied with their annual merit evaluation rating may request a peer review based on primary unit or school/college procedures. See Administrative Policy Statement 5008 – Faculty Performance Evaluations.

(B) Faculty members who are not satisfied with their annual salary have the right to appeal through campus-defined administrative processes and to seek a review of that appeal.

(C) For any perceived violations of academic freedom or academic rights, including those that may be associated with a salary appeal, a grievance to the Faculty Senate Grievance Committee (FSGC) may be filed in accordance with regent policy 5.G (See regent policy 5.G.1.C).

11.B.5 Explanation of Terms

A) Merit

Merit is the prevailing factor in all salary increases at the University of Colorado. Peer evaluation of faculty performance in the areas of teaching, scholarly/creative work, and leadership and service, and where applicable, other categories specific to the unit (e.g., clinical activity, librarianship) forms the basis for merit increases. Salary adjustments or increases that take into account market, career merit inequities, salary equity, promotion, or institutional priorities must be simultaneously based on merit.(B) Career MeritYear-to-year variations in the amount of funds in the available salary pool as well as the timing of faculty productivity can lead to salary inequities over time. Evaluations using career merit allow a unit to remedy any inadvertent discrepancies caused by the vicissitudes of budgets and timing of productivity.(C) Market AdjustmentsMarket adjustments are salary adjustments given to the primary unit to match significant competitive changes in the salary available to members of a particular discipline or specialty at comparable institutions.(D)Primary UnitThe primary unit is composed of professional colleagues having authority to make personnel recommendations concerning reappointment, tenure, and promotion. In schools and colleges with departmental organizations, each department will constitute a primary unit. In a school or college without such organization, all tenured and tenure-track faculty members have the responsibility for developing the terms of their working structure whereby the primary unit is defined. The primary unit may be a division or may be a school or college as a whole. In some instances, the primary unit may involve faculty from cognate departments or institutes.(E) Salary EquityThe university is committed to salary equity for all members of the faculty and follows a practice of periodic equity reviews of salary profiles to compare others in the primary unit.(F) Salary PoolThe term salary pool, approved annually by the Board of Regents, supports both annual merit evaluation-based salary adjustments and adjustments for market, career merit inequities, salary equity, promotion, and institutional priorities.

1At the Anschutz Medical Campus, faculty covered by alternative faculty compensation plans shall follow the requirements of those plans. Such plans may include terms and procedures that differ from those contained in this regent policy. In addition, processes for salary pool allocations and annual faculty evaluation at the Anschutz Medical Campus may vary from those described in this policy.

History

- Adopted: May 19, 2009,

- Replaces and incorporates the provisions of Regent Policy 11.F.2: Compensation Principles and Policy for Faculty and Glossary,

- Replaces and incorporates the provisions of Regent Policy 11.F.2: Addendum to Compensation Principles and Policy for Faculty,

- Replaces and incorporates the provision of additional pay for extra work contained in Regent Policy 5.D Additional Remuneration For Extra Work,

- Incorporates the provision for faculty salary computation for a faculty member ending an administrator appointment and returning to a faculty appointment contained in Regent Policy 3.I: Compensation for Administrative Officers Returning to Any Faculty Positions (now regent policy 3.H).

- Revised: April 29, 2014; April 17, 2015 (the term “officer and exempt professional” was replaced with the term “university staff”); February 10, 2022 - revised for changes related to the Colorado Equal Pay for Equal Work Act and made retroactive to January 1, 2021; May 9, 2022 - administrative change made to address faculty grievance language by adding updated language that was removed from regent policy 10.E; June 22, 2023.

- Last Reviewed: June 22, 2023.

- Non-substantive Changes: July 30, 2025 (Conforming amendments made for renumbering of regent laws and policies: reference to Regent Policy 10.E: Compensation Principles changed to Regent Policy 11.A: Compensation Principles).

Policy 11.C: University Staff Salary

11.C.1 Salary Setting

As the major component of compensation, salary levels for university staff reflect the university's policy of providing base salaries comparable to those paid by institutions of similar enrollment, organization, and financial support to persons in positions of comparable responsibility. Base salary also consider differences in the scope of responsibilities of university personnel and typical positions of similar title in other institutions. Where relevant, comparisons are made with salaries in government and business.

(A) Human Resources recommends initial salaries for university staff consistent with market conditions, education, training, or other relevant experience of the individual to the extent they are reasonably related to the position in question, and salaries for similarly situated employees as defined by applicable law. The president or their delegee approves the appointments and recommended initial salaries as stipulated in Regent Policy 2.K: Personnel Authority for Employees Exempt from the State Personnel System.(1) Initial salaries must be within a range specified at the beginning of the search process. Exceptions are permitted in extraordinary circumstances with appropriate approvals.(B) Housing allowances, automobile allowances, and use of courtesy cars constitute forms of supplemental pay and should be documented in the letter of offer or the letter of offer addendum and should be approved per regent policy 2.K.

(C) Hiring (recruitment) incentives are either lump sum amounts or base-building salary adjustments that are paid at a specific time within an appointment or when a documented competency/requirement is met. Either type of hiring incentive should be documented in the letter of offer or the letter of offer addendum and is approved per regent policy 2.K and should be offered in accordance with applicable law.

(D) Moving incentives are either a lump sum amount, a reimbursement of actual moving costs, or directly paying a moving company on the employee’s behalf. All moving expenses are taxable and should be documented in the letter of offer or letter of offer addendum and should be offered in accordance with applicable law.

(E) Initial salaries for university staff serving in an acting or interim capacity will be recommended by human resources with market conditions, education, experience, comparable positions, and approved budget and will be subject to the regular approval process.(1) An increase or stipend1 for serving in an acting or interim role is not required but may be authorized. Upon completion of service in the acting or interim capacity, the employee's salary will return to the former standard appointment salary including any changes resulting from the annual compensation process.

(2) Employees in acting or interim positions may have the salary associated with their standard appointment (i.e., base salary) adjusted during the annual salary-setting process. The additional salary associated with the interim position would then be recalculated and/or added to the adjusted salary for the standard appointment.

1A stipend is a form of additional pay added to annual compensation for duties or services the employee provides outside the primary position’s scope of responsibilities.

11.C.2 Base-Building Allocation

The university administers an annual process for salary adjustments.2 As part of the annual salary adjustment process, each campus and system administration will determine the budget for salary adjustments and a salary plan to allocate that budget. Performance-based, structural, across-the-board, market, retention and/or equity increases should be identified within and funded from the salary plan.(A) Annual Salary AllocationThe Board of Regents shall approve and distribute details on the annual salary allocation process for university staff to the campuses and system administration each year.(B) Base-Building Allocation Plan and ReportEach campus and the system administration shall develop a plan, consistent with this policy, to be followed at every organizational level. Annually, each campus and system administration will provide a report to the board on the implementation of their base-building allocation plan.

2Salary adjustment may be an increase or decrease in salary.

11.C.3 Non-Base Building Salary Allocations

(A) The campuses and system administration may administer an annual process for non-base building salary adjustments. As part of the annual salary adjustment process, each campus and system administration may determine the budget for non-base building adjustments to allocate the one-time funds.

(B) If the non-base building adjustments are not across-the-board, methods must be developed to assess an individual's merit, market, or equity in relation to a relevant internal peer group. The assessment must support the recommended salary adjustments. Performance planning and evaluation must be included for determining merit payments.

11.C.4 Base Salary Adjustments

Base salary adjustments are distinct from annual base-building increases. A hiring authority may adjust an employee’s base salary for reasons defined in APS 5061 - Compensation Changes. The president or their delegee approves the salary adjustments stipulated in regent policy 2.K.

11.C.5 Non-Base Building Payments

In certain instances, additional non-base building pay is necessary to the mission of the university. The president or their delegee approves non-base building payments as stipulated in regent policy 2.K and for reasons defined in APS 5061 – Compensation Changes.(A) Non-base building payments, other than merit, are to be used only in limited circumstances and must be properly documented and approved by the appropriate campus officers of the administration. Non-base building payments can include recognition, project completion, incentive, additional work integrated with regular assignments or at a substantially higher level or outside normal work hours.

(B) For overtime eligible positions, additional pay must not be used in place of earned overtime.

(C) Officers of the university are only eligible for non-base building payments upon approval by the Board of Regents upon the recommendation of the president.

(D) Implementation of these non-base building payments must be consistent systemwide with regard to taxation, retirement contributions and other benefits.

History

- Adopted: May 19, 2009,

- replaces and incorporates the provisions of former Regent Policy: 11.F.1 Salary Plan for Officers and Exempt Professionals,

- replaces and incorporates the provisions of former Regent Policy 11.B: Performance Rating, Planning, and Evaluation.

- Revised: April 17, 2015 (the term “officer and exempt professional” was replaced with the term “university staff”); and February 10, 2022 - revised for changes related to the Colorado Equal Pay for Equal Work Act and made retroactive to January 1, 2021; June 22, 2023.

- Last Reviewed: June 22, 2023.

Policy 11.D: Benefits

11.D.1 Non-Salary Benefits

The university provides compensation beyond salary for eligible employees in the form of benefits. Benefits are authorized through the Board of Regents and include group insurance programs, such as medical, dental, life, and disability, and other benefits like flexible spending, paid leave, and retirement savings plans. New and revised university benefit programs, including eligibility, must be approved by the Board of Regents.

For university employees who are members of the state personnel system (classified staff), benefits and eligibility are defined in accordance with state laws and Department of Personnel & Administration (DPA) rules. Eligible classified staff have the option of enrolling in university benefit plans.

The university, through its payroll system, offers employees the opportunity for payroll deduction for approved services and organizations. Such deductions must be approved through university and/or state policy.

11.D.2 Retirement Plans and Savings Programs

Eligible employees shall be enrolled in a retirement program as provided by applicable state law or as authorized by the Board of Regents. State and university retirement plans are contributory. The employer and employee levels of contribution to the retirement plans are subject to change and limitations set by federal tax law.

(A) Classified Staff:(1) Eligible classified staff enroll in one of the two PERA retirement plans: The PERA Defined Benefit (DB) Plan or, effective January 1, 2019, The PERA Defined Contribution (DC) Plan. Eligibility and rules are governed by Colorado PERA.

(2) Eligible classified staff may also choose to participate in the following voluntary retirement savings plans:(a) 403(b) Plan: The university-sponsored 403(b) Plan offers two retirement savings programs: the pretax option and the ROTH option.

(b) 457 Plan: The 457 Plan is a State of Colorado-sponsored retirement savings plan.

(c) PERA 401(k) Plan: The PERA 401(k) Plan is a PERA-sponsored retirement savings plan.

(B) Faculty and University Staff:(1) Eligible faculty and university staff enroll in the university sponsored 401(a) Optional Retirement Plan (401(a) ORP).Faculty and university staff who are active members in PERA who transfer into a position eligible for the 401(a) ORP may be required to make a one-time irrevocable enrollment decision to remain in PERA or enroll in the 401(a) ORP.

(2) Eligible faculty and university staff may also choose to participate in the following voluntary retirement savings programs:(a) 403(b) Plan: The university-sponsored 403(b) Plan offers two retirement savings programs: the pretax option and the ROTH option.

(b) 457 Plan: The 457 Plan is a State of Colorado-sponsored retirement savings plan.

(c) PERA 401(k) Plan: The PERA 401(k) Plan is a PERA-sponsored retirement savings plan.

The Board of Regents maintains responsibility for the number and types of investment options as well as for the amount of employee and employer contribution levels for the 401(a) ORP. In addition, the board maintains responsibility for defining retirement plan eligibility. The administrative duties, including management of vendor contracts and employee enrollment processes, are carried out by the university’s plan administrator.

(C) Graduate Medical Education (GME) Residents:(1) Eligible GME Residents are automatically enrolled in the university-sponsored 403(b) Plan and are eligible for an employer contribution.

(2) In addition to the 403(b) Plan, eligible GME Residents may also choose to participate in the following voluntary retirement savings programs:(a) PERA 457 Plan: The PERA 457 Plan is a PERA-sponsored retirement savings plan.

(b) PERA 401(k) Plan: The PERA 401(k) Plan is a PERA-sponsored retirement savings plan.

11.D.3 Age and Years of Service Requirements for the University’s Post-Retirement Benefits

(A) Classified Staff and Other University Employees Enrolled in a PERA Retirement PlanTo be eligible for university retirement benefits offered in addition to a PERA Retirement Plan, employees must have five (5) years of eligible CU Service and are required to retire (does not include a refund of your DB account) with PERA.

The combined years of service and age requirements for a PERA Retirement Plan are governed by PERA in accordance with Title 24, Article 51 of the Colorado Revised Statutes, and the Rules of the Colorado Public Employees' Retirement Association (visit the PERA website at: https://www.copera.org/).

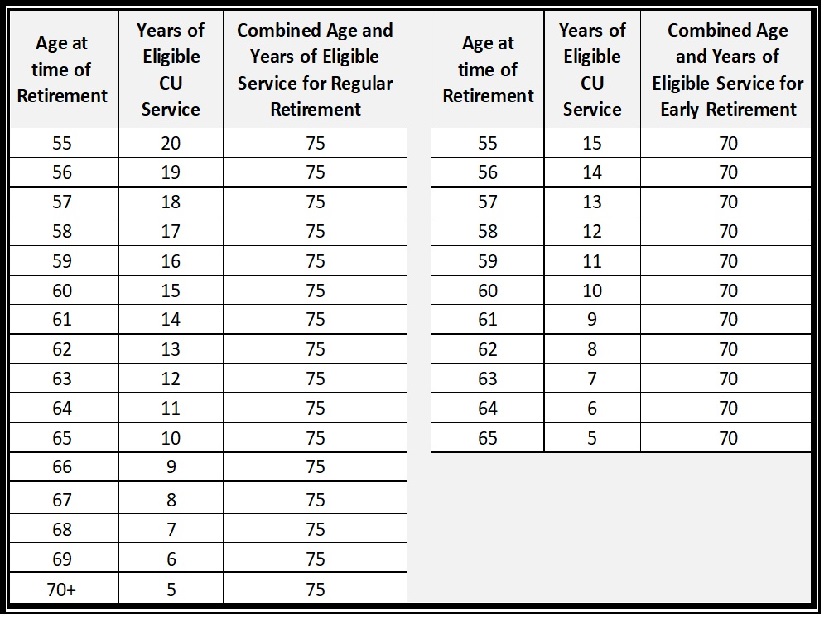

(B) Faculty and University Staff Enrolled in the 401(a) ORPTo be eligible for university retirement benefits offered in addition to the 401(a) ORP, employees must be 55 years of age; have five (5) years of eligible CU Service; and meet the age and years of eligible CU service requirements for regular or early retirement.

Regular or early retirement is based on the 70/75 formula. If the combined age and years of eligible CU service for a faculty or university staff member enrolled in the 401(a) ORP adds up to 75 or more, that individual is eligible for regular retirement and is entitled to receive 100% of the University of Colorado contribution towards retiree insurance benefits upon retirement. If the age and years of eligible CU service adds up to 70-74, the individual is eligible for early retirement, and the University of Colorado contribution towards retiree insurance benefits will be pro-rated based on the actual years of eligible CU service divided by the required years of eligible CU service for regular retirement. Eligible years of CU service will include all years in which the employee worked in a regular, retirement-eligible position at 50% time or greater at the University of Colorado.

Age and Years of Eligible CU Service Requirements for Regular and Early Retirement

(C) Faculty, University Staff, and Classified Staff Terminated and Ineligible for RehireIndividuals who have been terminated from the University of Colorado and are Not Eligible for Rehire are ineligible for any CU Retirement Benefits that are offered in addition to PERA or the 401(a) ORP.

11.D.4 Early Retirement Incentive Programs

(A) Retirement Incentive Agreements for Tenure and Tenure-Track Faculty. For the purpose of determining eligibility for a specific retirement incentive program for tenure and tenure-track faculty, such as a phased retirement program, the age plus years of service requirements may be reduced to total no less than 65 if the faculty member is at least 50 years of age upon retirement.

Also, tenure and tenure-track faculty may count years of service at other higher education institutions (employment of 50% time or greater) in determining whether the age plus years of service requirement is met if: (1) the faculty member will have been employed at the university for a minimum of five years prior to the retirement date in the retirement incentive agreement; and (2) the faculty member was age 55 or greater on the first date of employment at the university.

(B) Individualized Retirement Incentive Programs. The president is authorized to develop retirement incentive options in addition to phased retirement programs for faculty, including a “window program” and an “individualized retirement incentive program.” In a window program, employees in an identified group who meet a specified combination of age and years of service would be eligible for a separation incentive. In an individualized retirement incentive program, an incentive, drawn from a menu of options tailored to the individual employee, would be offered to the employee. These options are considered perquisites under State Fiscal Rules, and the Board of Regents authorizes the president to seek necessary approvals from the governor and the state controller to implement such options.

History

- Adopted: May 19, 2009,

- replaces and incorporates the provisions of Regent Policy 11.D Qualified Retirement Plan,

- replaces and incorporates the provisions of Regent Policy 11.E 401(a) Optional Retirement Plan for Faculty and Unclassified Staff,

- combines benefits section from Regent Policy 11.F.2: Compensation Principles and Policy for Faculty,

- replaces and incorporates the provisions of Regent Policy 11.F.2, addendum to Compensation Principles and Policy for faculty,

- replaces and incorporates the provisions of Regent Policy 11.I Age And Years Of Service Requirements For Faculty, Officers And Exempt Professionals Who Are Not Retiring With Public Employees Retirement Association (PERA) Retirement,

- clarifies that in accordance with the Laws of the Regents, Article 11: Compensation, classified staff have the option of enrolling in benefit plans that are approved by the state Department of Personnel and Administration or selected university benefit plans.

- Revised: April 17, 2015 (the term “officer and exempt professional” was replaced with the term “university staff”); and February 10, 2022; April 10, 2025 (Added GME Resident eligibility for employer contribution); TBD.

- Last Reviewed: April 10, 2025.

- Non-substantive Changes: April 2024; July 30, 2025 (Conforming amendments made for renumbering of regent laws and policies: Regent Policy 11.F: Benefits renumbered to Regent Policy 11.D: Benefits).

Policy 11.E: Leave Policies for Employees

11.E.1 Vacation

(A) Nine-Month Faculty(1) Accrual. Nine-month faculty on academic appointments do not accrue vacation leave.(B) University Staff and Twelve-Month Faculty

(2) Compensation. N/A.(1) Accrual.Full-time university staff and faculty on twelve-month appointments are eligible to receive twenty-two (22) working days (176 hours) of paid vacation annually, earned as 14.67 hours per month. An eligible employee who works part-time (less than 100%) accrues vacation on a prorated basis. Eligible employees on leave without pay, except for military leave without pay and furloughs, do not accrue vacation leave. Vacation accrual may not exceed forty-four (44) days (352 hours) on July 1 of every year.

(2) Compensation. Direct compensation is not provided in lieu of use of earned vacation. Upon retirement or termination of employment, not including transfers or intent to be rehired at CU within thirty (30) days, direct payment is made in the equivalent amount of the employee's earned unused vacation time up to a maximum of forty-four (44) days (352 hours) per separation from employment from the university. Vacation payout will be calculated at the employee’s compensation rate at the time of each separation from employment.(C) Classified Staff(a) For business needs, a campus may create a policy to pay all or a portion of the vacation accrual, up to the maximum of forty-four (44) days (352 hours), without formal separation from the university. The campus policy must include eligibility criteria, funding sources, and maximum leave payout.(1) Leave benefits for classified staff are governed by the State of Colorado Personnel Board Rules.

11.E.2 Sick Leave

(A) Nine-Month Faculty(1) Accrual. Sick leave benefits shall be available to faculty on nine-month appointments. Nine-month faculty on a 100% appointment will accrue eleven (11) days (88 hours) of sick leave annually, beginning on the first day of their eligible appointment. Eligible faculty who are on a part-time (less than a 100%) appointment accrue sick leave on a prorated basis. Eligible faculty on leave without pay, except for military leave without pay and furloughs, do not accrue sick leave.(2) Compensation. No compensation for unused sick leave shall be paid upon separation from employment with the university.(B) University Staff and Twelve-Month Faculty(1) Accrual.Full-time university staff and faculty on twelve-month appointments are eligible to receive fifteen (15) working days (120 hours) of paid sick leave annually, earned as 10 hours per month. Accrual begins on the first day of eligible appointment. Eligible employees who are on a part-time (less than 100%) appointment accrue sick leave on a prorated basis. Employees on leave without pay, except for military leave without pay and furloughs, do not accrue sick leave.(C) Classified Staff

(2) Compensation.(a) Unused, accrued sick leave may be compensated when the employee separates from employment with the university and meets the age and service eligibility requirements for University of Colorado’s Post-Retirement Benefits, per Board of Regent Policy 11.D.3.

(b) Once the sick leave compensation is paid, the employee’s remaining accrued sick leave balance will be removed, leaving the accrued sick balance at zero hours. An employee is eligible for sick leave compensation one time only, unless the employee rescinds their retirement with both CU and their respective retirement vendor and is subsequently employed in a leave-eligible position, in which case the eligible sick leave compensation will again be paid upon separation from the university.

(c) If an employee dies while actively employed, the spouse or estate will be compensated.

(d) The employee’s maximum sick leave accrual for purposes of compensation is 120 days (960 hours). The maximum compensation payout is 30 days (240 hours), which is ¼ of the employee’s maximum sick leave accrual, except as noted below. If an employee’s sick leave accrual balance is less than 120 days (960 hours), the compensation payout is ¼ of the balance the employee has accrued.i.For university staff and faculty on twelve-month appointments, accruals for the purpose of the maximum sick leave compensation will be based upon documented departmental sick leave records verified as of May 1, 2001.(e) Sick leave payment will be calculated at the employee’s compensation rate at the time of each retirement-eligible separation from the university or upon death.

ii. Any employee whose documented accrued sick leave was in excess of 120 days (960 hours) on May 1, 2001, will use the entire accrued balance as of May 1, 2001, to identify their maximum sick leave accrual for purposes of compensation. These employees will be eligible to receive compensation payment for one-fourth (¼) of any unused portion of the accrued balance.(1) Leave benefits for classified staff are governed by the State of Colorado Personnel Board Rules.(D) All Other Faculty on Contracts (including student faculty)(1) All other faculty and student faculty on a 100% appointment shall be eligible for three (3) days (24 hours) of sick leave per semester but no more than nine (9) days (72 hours) annually. Accrual begins on the first day of eligible appointment. An eligible employee who works part-time (less than 100%) accrues sick leave on a prorated basis. Employees on leave without pay, except for military leave without pay and furloughs, do not accrue sick leave.(E) All other Paid Employees (including non-contract temporary and student hourly employees)

(2) Accrual may not exceed six (6) days (48 hours) on July 1 of every year.

(3) Up to six (6) days (48 hours) of accrued sick leave may be carried over from year to year. C.R.S. § 8-13.3-403(3)(b).

(4) Compensation. No compensation for unused sick leave shall be paid upon separation from the university.(1) Other employees paid monthly or hourly are eligible to accrue 0.034 hours of sick leave for every hour worked. Accrual begins on the first day of eligible appointment. An eligible employee who works part-time (less than 100%) accrues sick leave on a prorated basis. Employees on leave without pay, except for military leave without pay and furloughs, do not accrue sick leave.

(2) Accrual may not exceed six (6) days (48 hours) on July 1 of every year.

(3) Up to six (6) days (48 hours) of accrued sick leave may be carried over from year to year. C.R.S. § 8-13.3-403(3)(b).

(4) Compensation. No compensation for unused sick leave shall be paid upon separation from the university.

11.E.3 Other Types of Leave

The president may establish additional types of leave as determined by federal and state law or as deemed necessary for specific employment classifications. Examples include: court and jury leave, military leave, bereavement leave, leave for job-related illnesses and injuries, leave without pay, parental leave, administrative leave, leave sharing and furloughs.

11.E.4 Verification of Leave Accruals and Recording Leave Usage

(A) Each employee and supervisor is responsible for maintaining accurate and complete vacation and sick leave records within their department or unit. These records will be used to verify leave benefits involved in termination, retirement, or transfer. This record must accompany termination documents for payment of annual leave and sick leave if eligible for retirement.

(B) Each supervisor is responsible for ensuring that these policies for vacation, sick leave, and other leaves are applied in a consistent manner and in consultation with appropriate human resources personnel, where necessary, to achieve substantial uniformity across all campuses of the University of Colorado.

History

- Adopted: May 9, 2002 - Regent Policy 11.H - Leave Policies.

- Revised: May 19, 2009. The current revisions incorporate the provisions of Regent Policy 11.J - Parental Leave for Faculty, Officers and Exempt Professionals, recommended for rescission. As part of the May 19, 2009 resolution, the board authorized staff to reformat and renumber the sections contained in Regent Policy 11. The policy was renumbered as Policy 11.E; April 17, 2015 - The term “officer and exempt professional” was replaced with the term “university staff”; April 2, 2020 - An interim provision to 11.E.1(B)(1) was approved on May 19, 2020, and was repealed on July 1, 2021; April 8, 2021, and made retroactive to January 1, 2021.

- Last Reviewed: April 8, 2021.

- Non-substantive Changes: April 2024; July 30, 2025 (Conforming amendments made for renumbering of regent laws and policies: Reference to regent policy 11.F.3 changed to regent policy 11.D.3).