How to Manage Life Insurance Beneficiaries [1]

What is a beneficiary?

- A person or an organization you name to receive your life insurance policy amount in the event of your death.

- Two types of beneficiaries are available:

- Primary beneficiary: Receives the benefit in the event of your death.

- Contingent beneficiary: Receives the benefit if the primary beneficiary(ies) are deceased.

If you do not name a beneficiary, the benefit will be paid out in accordance with group policy provisions.

Who can be a beneficiary?

- One person

- Two or more people

- Trustee

- A charity or organization

- Your estate

Watch these videos for instructions to add a beneficiary

How to add, change or remove beneficiary(ies) from a life insurance policy

Step-by-step guide

- Log into your employee portal [2].

- Select CU Resources (skip this step if CU Resources is your homepage.)

- Click on the Benefits & Wellness tile.

- Click on the Benefits Summary tile.

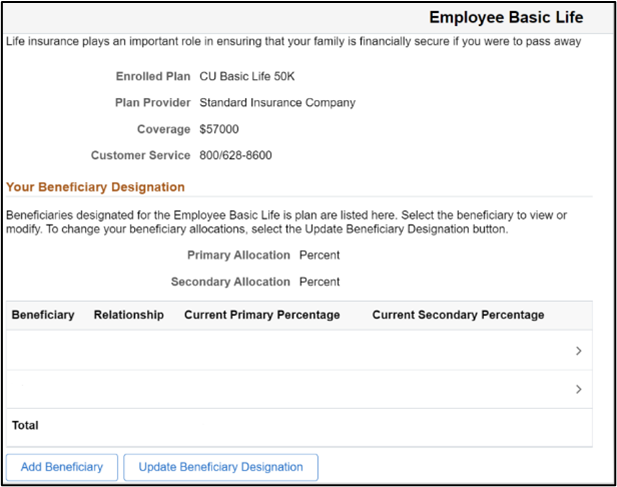

- On the summary, click on the plan(s) you want to edit beneficiaries for: Employee Basic Life, Employee Optional Life and/or Employee Voluntary AD&D.

- You can now complete the following actions:

- Add beneficiaries

- Change the percentages of current beneficiaries (the total percentage between beneficiaries must total 100 percent).

- Remove a beneficiary by changing the percentage to 0 percent. Note: If you no longer wish to see this individual in your employee portal, submit the Dependent/Beneficiary Removal Form [3].

- Click Save. Changes will be effective immediately.

How to designate a charity or organization as a beneficiary

Step-by-step guide

To add a trust, charity or estate as a beneficiary, the process is the same as above. However, instead of adding a person's name, you will add the name of the trust, charity, or estate.

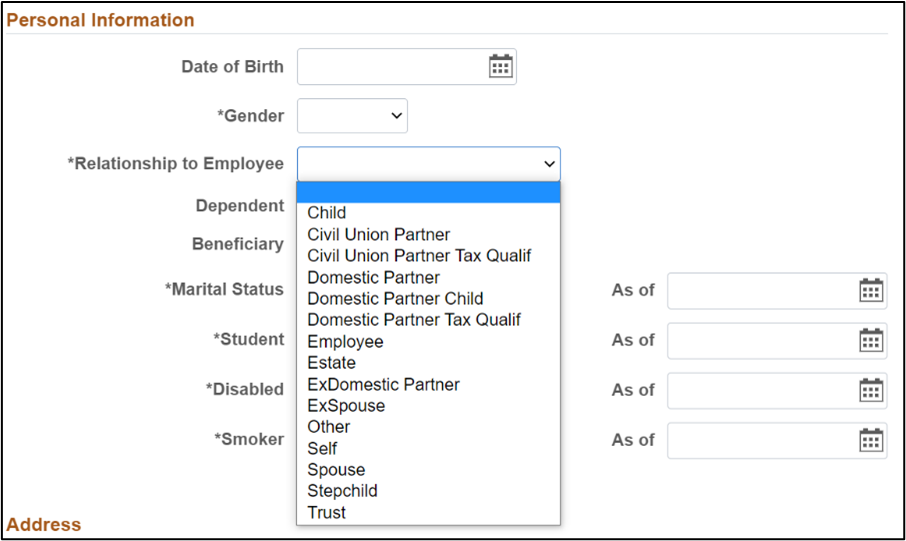

In the Personal Information section, answer the non-applicable, required question in any way, and they will be disregarded.

- Gender - Unknown

- Relationship to Employee - Select the appropriate relationship: trust, charity (other) or estate

- Marital Status - Any

- Student - Any

- Disabled - Any

- Smoker - Any

Beneficiary designation for those without portal access

If you do not have access to the employee portal, you can remove a beneficiary using the Beneficiary Designation Form [4].

The Group Life Insurance Policy [5] details the terms of life insurance policies through The Standard Insurance Co. with University of Colorado as the Policyholder.

The Group Policy Amendment No. 23 [6] is attached to and made a part of the Group Policy above.