Can't see recent updates? Clear your cache

Step 1: Log in to the portal

Access your campus portal at my.cu.edu, select your campus, and enter your username and password.

If you need a login and password credentials, please see campus-specific assistance with your user ID and password.

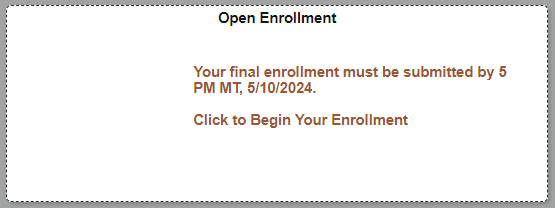

Step 2: Find the Open Enrollment tile

Once you have logged in to the portal, select the CU Resources tab. (If you do not see a CU Resources tab, it is your homepage.)

On your homepage, select the Open Enrollment tile.

Select Open Enrollment.

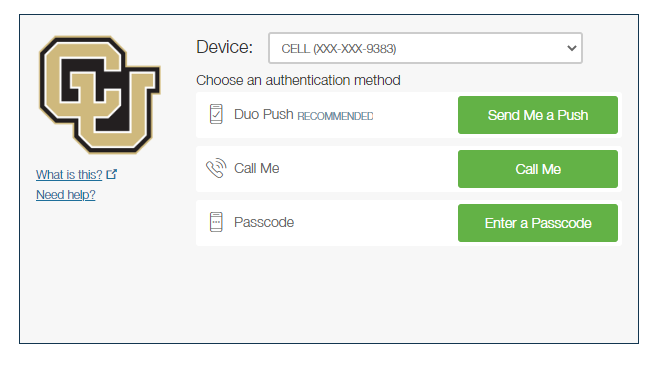

Step 3: Authenticate your identity

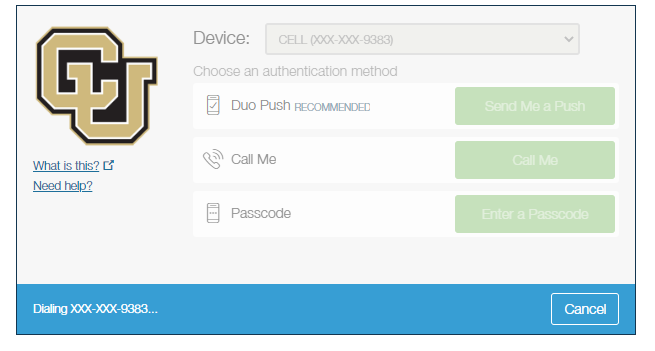

When you try to access a protected page in the portal's CU Resources area, a page like the one below will appear. You will be asked to authenticate your identity.

You will have authentication two options: Receive a phone call or receive a text message with a passcode.

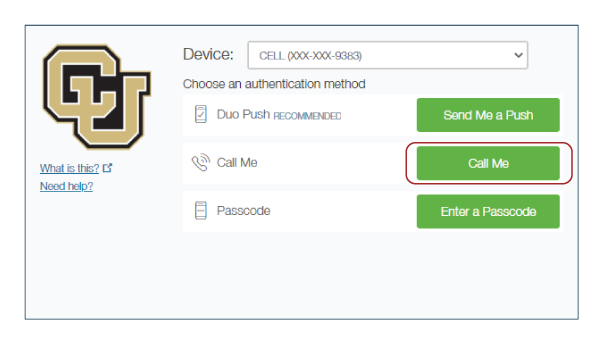

Option 1: Receive a phone call

| From the Device drop-down menu, select the phone number where you wish to be contacted. |  |

| Click the Call Me button. |  |

| Answer the call, then press any key on your phone to log in. The protected page will open. |

|

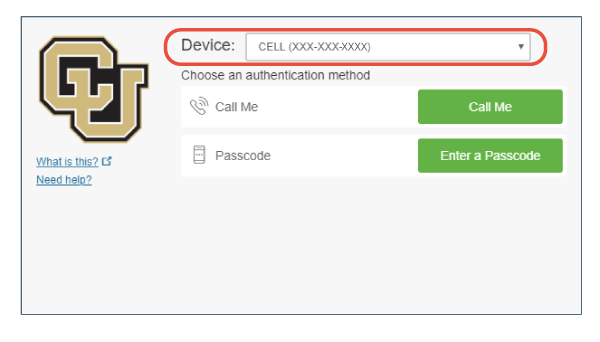

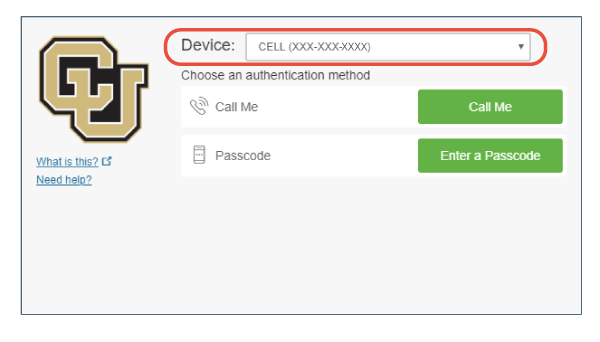

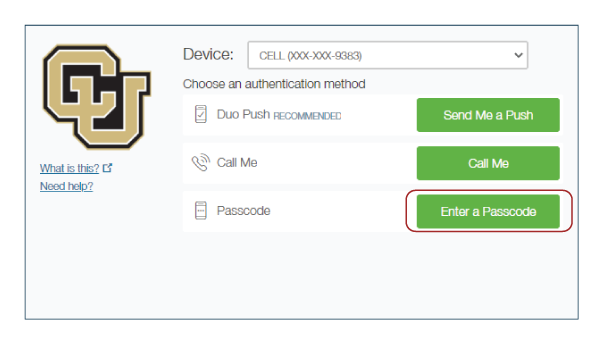

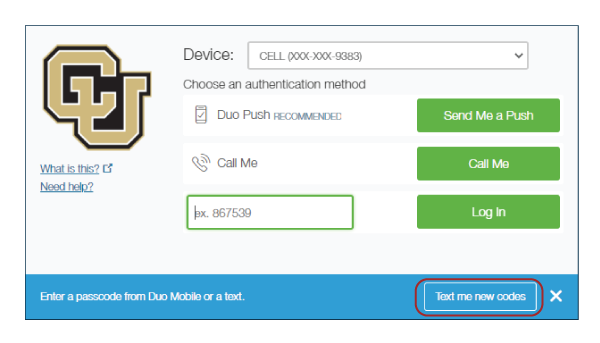

Option 2: Receive a text message with a passcode

| From the Device drop-down menu, select the phone number where you wish to be contacted. |  |

| Click the Enter a Passcode button. |  |

| A blue bar will appear on the screen. Press the Text me new codes button. |

|

| You’ll receive a text message from CU with a passcode. Enter the passcode and press the Log In button. The protected page will open. |

|

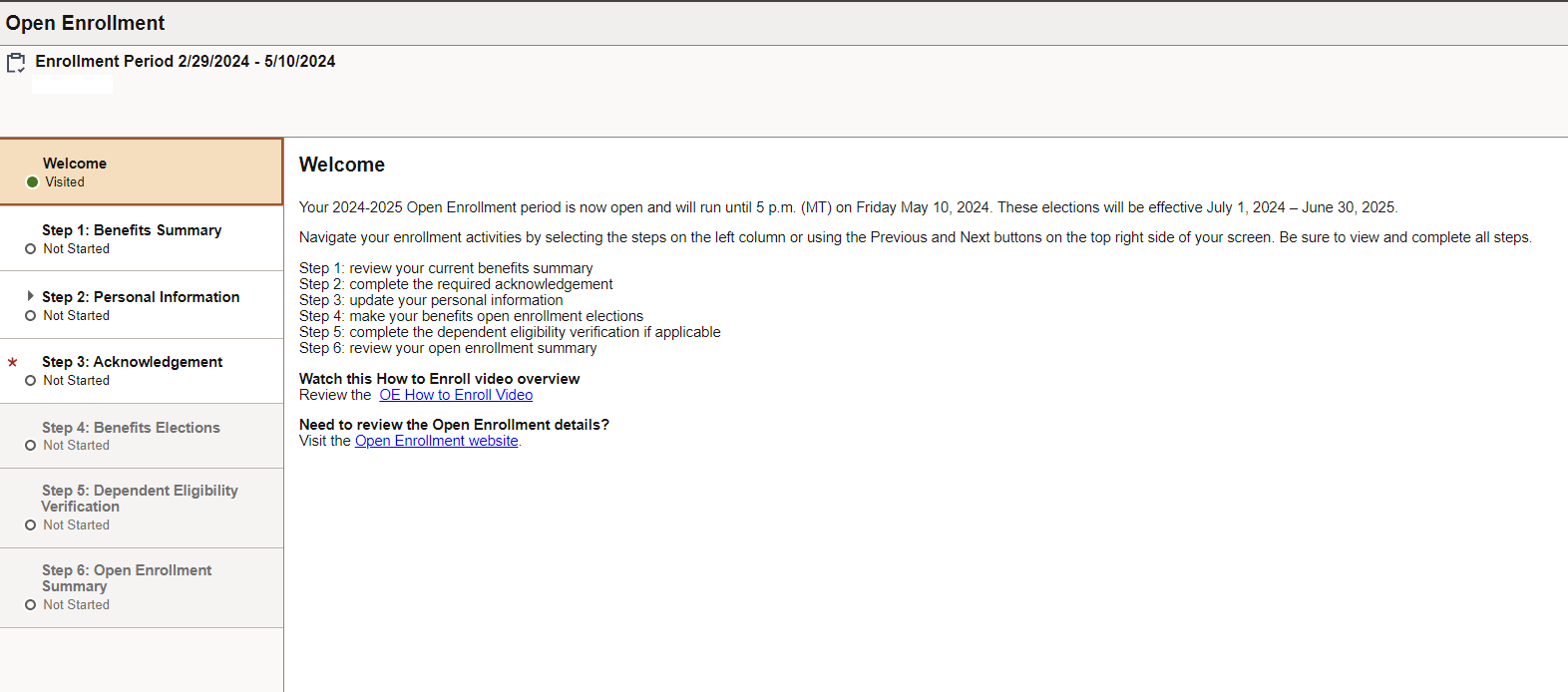

Step 4: Follow the steps on the activity guide

Note: You'll need to read and accept the Acknowledgement before you can begin selecting your benefits.

Step 5: Choose your plans

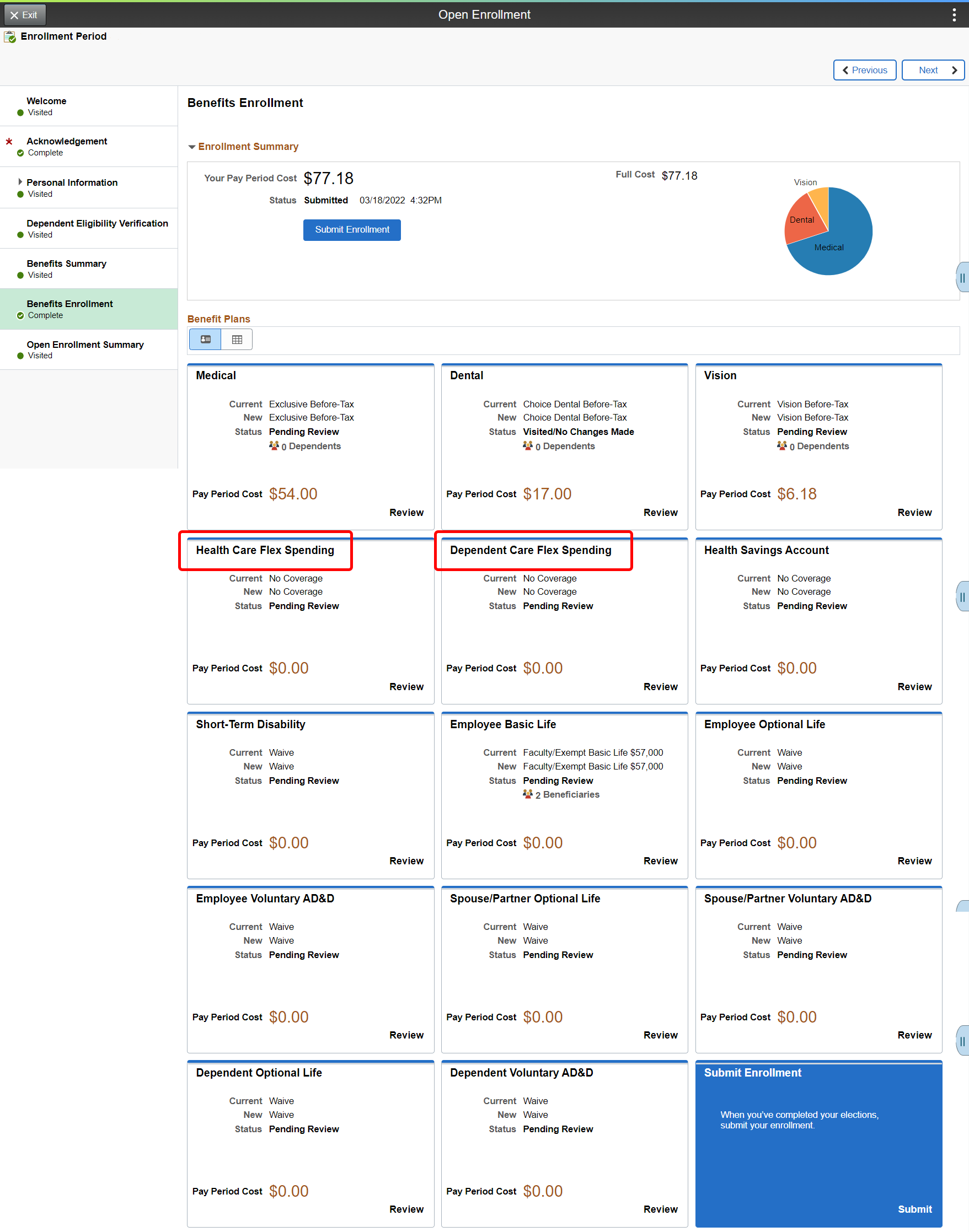

All benefits plans for which you are eligible will be listed. On each tile, click the Review link to see your options, enroll, change or waive benefits plans.

Please note: If you are currently enrolled in a Flexible Spending Account — either the Health Care FSA or the Dependant Care FSA marked with red boxes below — you will need to re-enroll in order to have access to an FSA for the next plan year.

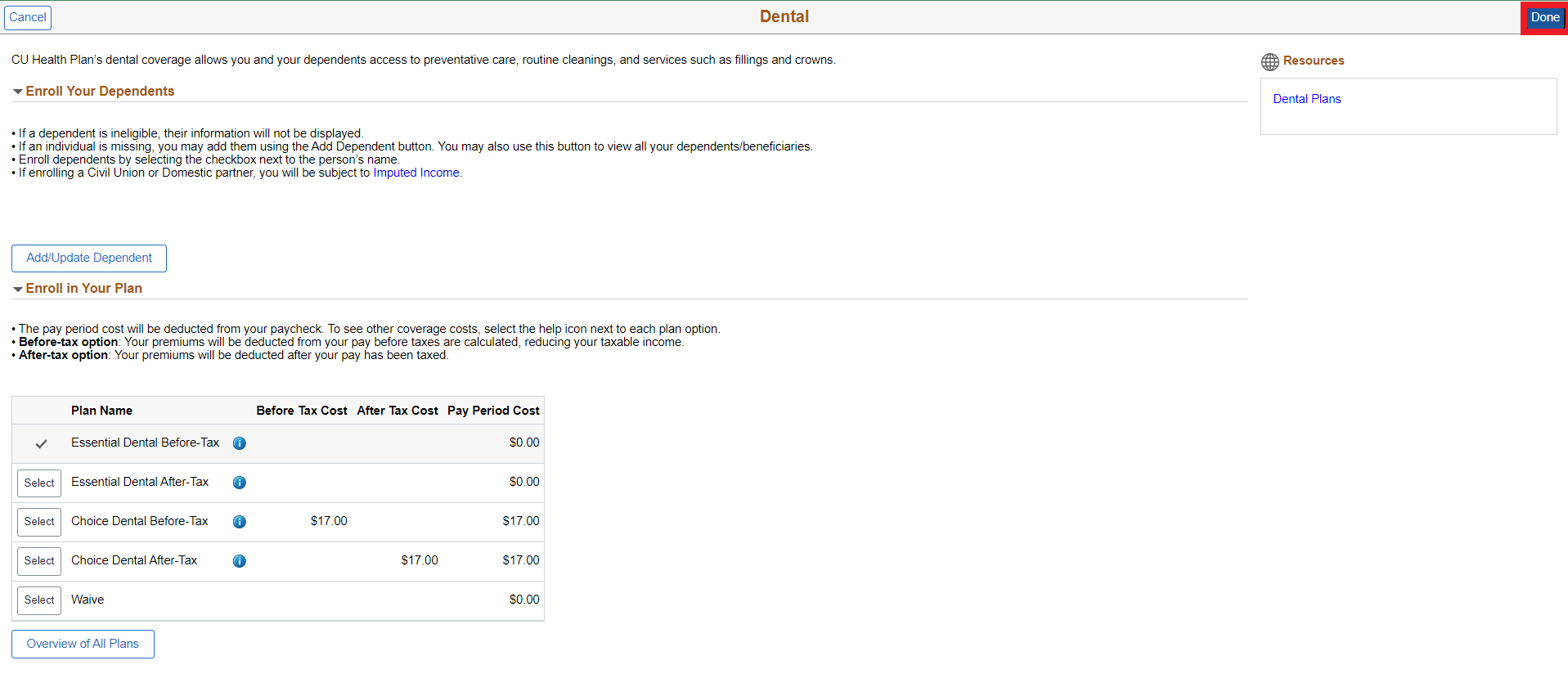

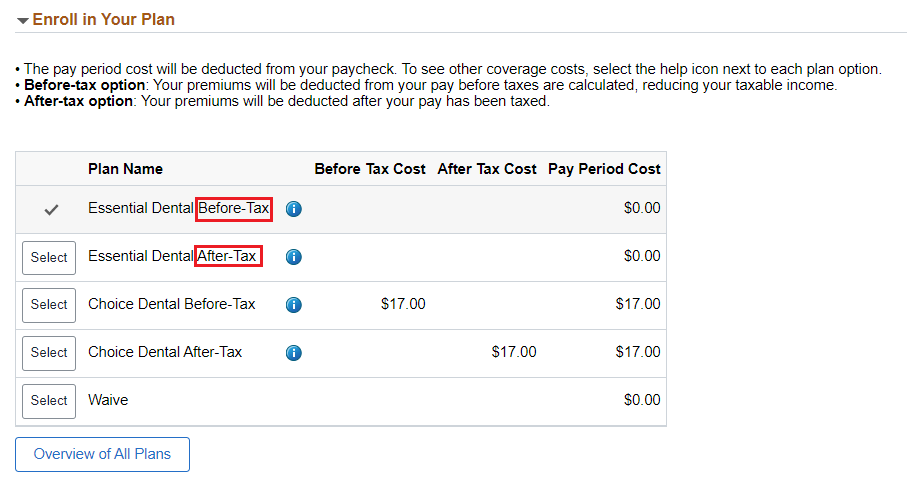

Changing any of these benefits is simple. For example, if you select the Dental tile, you will reach a page where you can elect your plans and enroll any dependents you want covered. The first section you'll see on the Dental enrollment page is the Enroll Your Dependents section. Click Add/Update Dependent to reach a page where you can add dependents or update the information for any dependents or beneficiaries already listed on your plan.

Below the dependent enrollment section, you can choose among the available plans and select whether you want your coverage premiums deducted from your pay before or after your taxes are deducted. If you would like to see charts of the costs for each plan type and coverage level (individual, individual + spouse, etc.), click the "Overview of All Plans" button and a popup window will open.

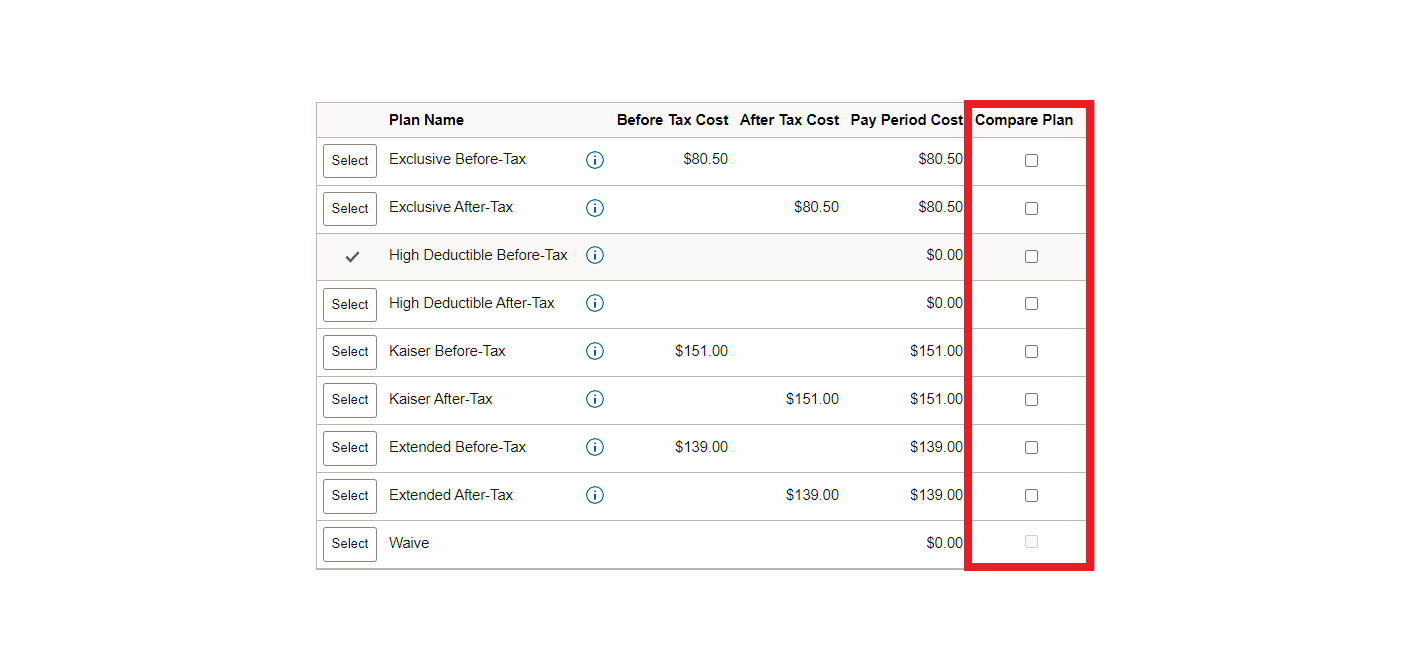

You can compare medical plans within the portal. Select the plans you'd like to see, and you can compare rates, deductibles, urgent care costs and more within the portal.

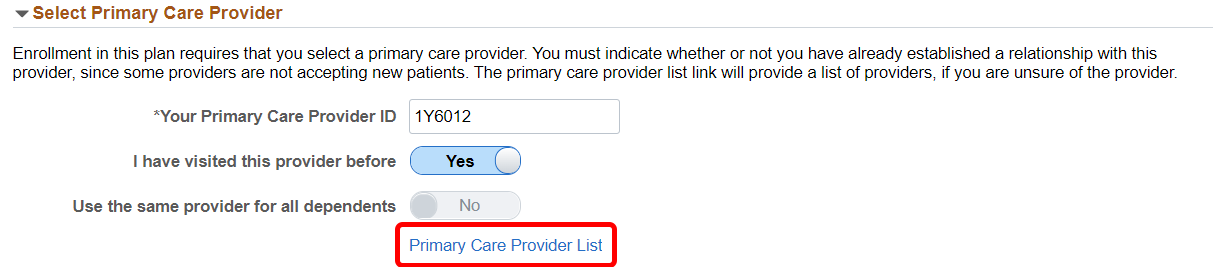

Some plans will require you to list your primary care provider. You can use the Primary Care Provider List to find their provider ID. If you don't have a provider yet, you can choose one from the provider list and select "No" where it says "I have visisted this provider before."

Once you've finished making any elections or updates you wish to make on any given plan page, be sure to click Done in the upper right-hand corner of the enrollment page.

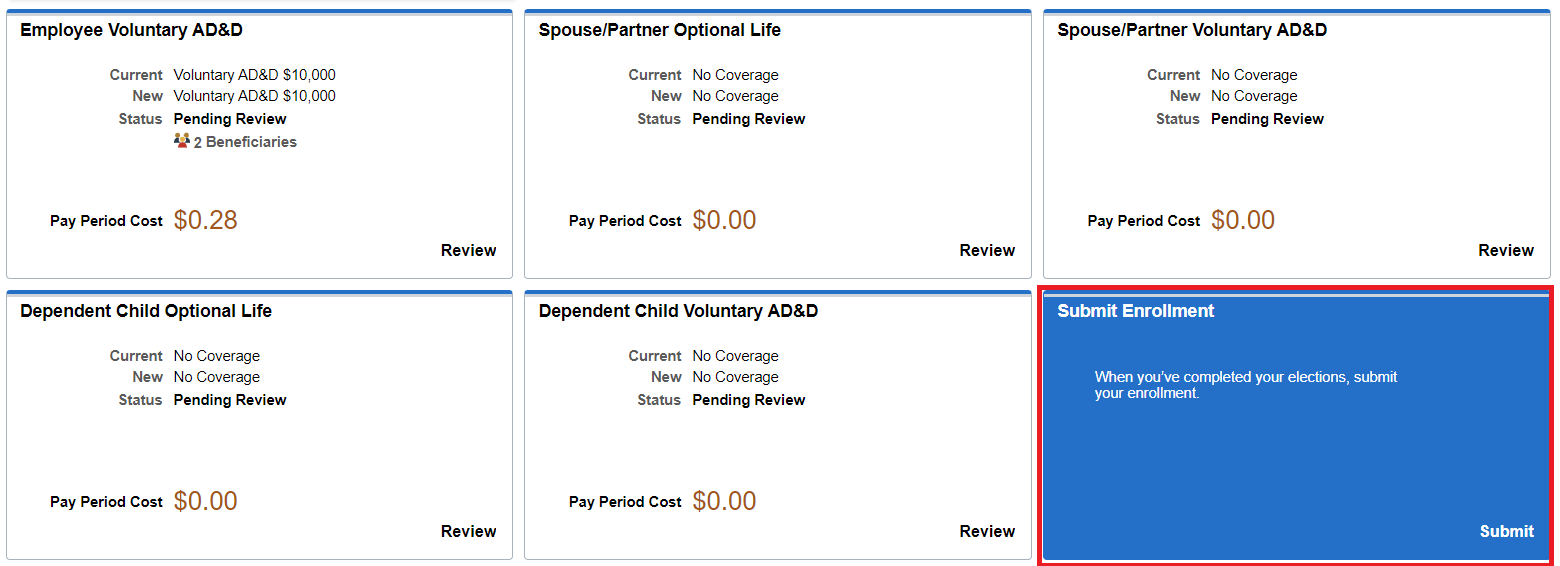

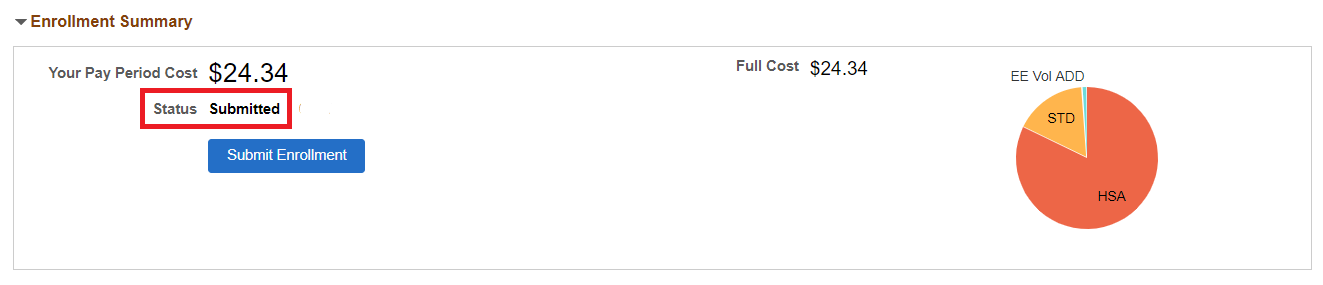

Step 6: Click Submit Enrollment

Review the page and verify that you have made all of your benefits selections.

To complete your enrollment, click the Submit Enrollment box on the bottom right of the page.

A message will appear that all benefit choices have been successfully submitted to the Employee Services benefits department.

Step 7: Review your benefits

Once you submit your enrollment, you'll recieve an email confirmation. In the enrollment tool, your Enrollment Summary status will show as Submitted.

You may review your selections through the portal's Benefits Summary on the next business day.

To access your Benefits Summary: Select the Open Enrollment tile on your homepage and then select Benefits Summary.

To view your new elections, enter "7/1/2023" in the date field and press the Refresh button.

What do you want to do?

I want to enroll in benefits.

Once you're logged in, you can view your current benefits (if you have any) and enroll in plans for the upcoming plan year. Once you've completed your enrollment, you can view your new enrollment elections right in the portal. This is your confirmation of enrollment.

Need the paper form?

The fastest way to complete your enrollment is by using the benefits enrollment tool, but for some tasks you will need a paper form. For a qualifying life event, complete one of benefits enrollment/change forms below to request your changes.

To check your benefits:

- Once you've logged in to the employee portal, click on the CU Resources tab. (CU System employees can skip this step.)

- You can find your benefits summary by clicking on the Open Enrollment tile, then selecting Benefits Summary.

- To see your benefits for the current year, enter your benefits effective date (for example: "7/1/2024") and press Refresh.

- You will then see an updated version of your benefits.

Retiree portal access

If you are a retiree who has never enrolled online, please review these instructions to get your portal username and password.

I want to add a dependent.

- Spouses, Common-Law Spouses, Civil Union Partners and Domestic Partners

- Dependent children up to age 27

- Qualified disabled children over age 27

Complete the Dependent Eligibility Verification and submit it with the documentation listed upon completion of your self-service elections. Documentation must be received by Employee Services by your enrollment deadline or within 31 days of a qualifying event.

Dependents only have to be verified once; verification carries over year-to-year.

I want to change benefits as part of a qualifying event.

Qualifying life events include marriage, divorce, birth, gaining/losing other coverage, gaining/losing eligibility, change in employee residence and changes in dependent care needs.

For a qualifying event, complete a Benefits Enrollment/Change Form to make benefits changes that are effective before July 1.

I want to increase my employee or spouse optional life coverage.

- To apply to increase your coverage, you must submit a Medical History Statement Form to The Standard Insurance Company as evidence of insurability (EOI). If you are approved, Standard will notify CU, and you will be enrolled in the approved amount on the first of the month following the date of your approval.

- If you want to remain enrolled, but would like to decrease your coverage, you may do so using the Benefits Enrollment tool within the employee portal.

This table shows the plan(s) in which you will be automatically enrolled if you do not take action during the enrollment period.

Start by locating your current plan(s) in the left column.

| 2024-25 Auto-Enrollment What happens if you take no action |

||||||

| 2023-24 Enrollment Status | Eligible Participant | 2024-25 Default | ||||

| Medical Plans | ||||||

| Waived medical coverage | All members | Waived coverage continues | ||||

| CU Health Plan - Exclusive | Active faculty and staff, GMEs, retirees and surviving spouses who are not eligible for Medicare | Same plan and coverage level | ||||

| CU Health Plan - Extended | ||||||

| CU Health Plan - Kaiser | ||||||

| CU Health Plan - High Deductible | ||||||

| CU Health Plan - Medicare | Medicare-eligible retirees and surviving spouses | |||||

| CU Health Plan - Medicare/High Deductible | Retirees and surviving spouses when at least one member is Medicare-eligible | |||||

| Alternate Medicare Payment (AMP) | Medicare-eligible retirees and surviving spouses | |||||

| Dental Plans | ||||||

| Waived dental coverage | All members | Waived coverage continues | ||||

| Active faculty and staff, GMEs, retirees and surviving spouses who are not eligible for Medicare | ||||||

CU Health Plan - Essential |

||||||

| Same plan and coverage level | ||||||

| CU Health Plan - Choice | Same plan and coverage level | |||||

CU Health Plan - Dental Premier |

Retirees and surviving spouses when at least one member is Medicare-eligible | Same plan and coverage level |

||||

| Vision | ||||||

| Waived vision coverage | All members | Waived coverage continues | ||||

| CU Health Plan Vision | All benefits-eligible faculty, staff and GMEs | Same plan and coverage level | ||||

| Life Plans | ||||||

| Waived Optional Life coverage(s) | Faculty, staff and retirees | Waived coverage continues | ||||

| CU Basic Term Life | Faculty and staff and retirees | Same plan, same coverage level, same rate level (smoker/nonsmoker, if applicable) as long as you remain enrolled in Optional Life plan | ||||

| CU Optional Term Life - Employee and Retiree | ||||||

| CU Optional Life - Spouse | Faculty and staff | |||||

| CU Optional Life - Dependent Child | ||||||

| CU Free 10k Optional Life | ||||||

| Voluntary Accidental Death & Dismemberment - Employee | ||||||

| Voluntary Accidental Death & Dismemberment - Spouse | ||||||

| Voluntary Accidental Death & Dismemberment - Dependent Child | ||||||

| PERA Optional Life | ||||||

| Disability | ||||||

| Waived Classified Staff Long-Term Disability | Classified staff members | Waived coverage continues | ||||

| Waived Faculty/University Staff Short-Term Disability | Eligible faculty and university staff members | |||||

| Faculty/University Staff Short-Term Disability | Eligible faculty and university staff members | Same plan | ||||

| Faculty/University Staff Long-Term Disability | ||||||

| Classified Staff Short-Term Disability | Eligible classified staff members | |||||

| Classified Staff Long-Term Disability | ||||||

| Cafeteria Plans | ||||||

| Premium Only Plan | Active faculty, staff and GMEs | Same plan | ||||

| Health Care Flexible Spending Account | Not enrolled for plan year 2024-25 | |||||

| Dependent Care Flexible Spending Account | ||||||